Dow erases losses as tech rally helps overcome greenback stress

The Dow Jones Industrial Common erased earlier losses as a rally in tech shares offset greenback stress.

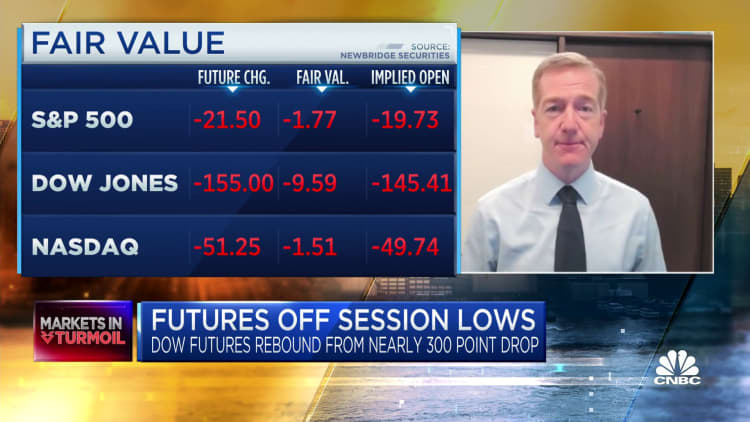

The Dow gained 14 factors, or 0.1%. The S&P 500 rose 0.6%, and the Nasdaq Composite superior 1.4%.

Client discretionary and data know-how gave help to shares, each up 1.3% and 0.8%, respectively. On line casino shares outperformed following information that China would permit tour teams in Macau for the primary time in almost three years. Wynn Resorts jumped 12.4%, and Las Vegas Sands was 11% increased. Tech shares Enphase Power and Salesforce rose 2.3% and 1.9%.

The British pound dropped to a record low on Monday towards the U.S. greenback. Sterling at one level fell 4% to an all-time low of $1.0382. The Federal Reserve’s aggressive climbing marketing campaign, coupled with U.Okay.’s tax cuts introduced final week has brought about the U.S. greenback to surge. The euro hit the bottom versus the greenback since 2002. A surging dollar can harm the earnings of U.S. multinationals and in addition wreak havoc on world commerce, with a lot of it transacted in {dollars}.

“Such U.S. greenback power has traditionally led to some form of monetary/financial disaster,” wrote Morgan Stanley’s Michael Wilson, chief U.S. fairness strategist, in a word. “If there was ever a time to be looking out for one thing to interrupt, this could be it.”

Merchants might be carefully watching the S&P 500 on Monday for any break under its bear market low. The S&P’s low shut for the 12 months in June was 3,666.77. It closed Friday at 3,693.23 after buying and selling briefly under that degree. The benchmark’s intraday low for the 12 months is 3,636.87. Any buying and selling under these ranges may drive extra promoting available in the market.

On Friday, shares ended a brutal week with the blue-chip Dow finding a new intraday low for the year and shutting decrease by 486 factors. The broad-market S&P 500 quickly broke under its June closing low and ended down 1.7%. The tech-heavy Nasdaq Composite misplaced 1.8%.

One other super-sized fee hike by the Federal Reserve final week was the catalyst for the newest leg downward in markets. The central financial institution indicated it may elevate charges as excessive as 4.6% earlier than pulling again. The forecast additionally exhibits the Fed plans to be aggressive this 12 months, climbing charges to 4.4% earlier than 2022 ends.

Bond yields soared after the Fed enacted one other fee hike of 75 foundation factors. The two-year and 10-year Treasury charges hit highs not seen in over a decade. On Friday, Goldman Sachs slashed its year-end target for the S&P 500 to three,600 from 4,300.

Charges have been surging once more on Monday with the 2-year Treasury topping 4.29% at one level within the day.

Source link