Carnival (CCL) Inventory Declines 54% in a 12 months: Is the Worst Over?

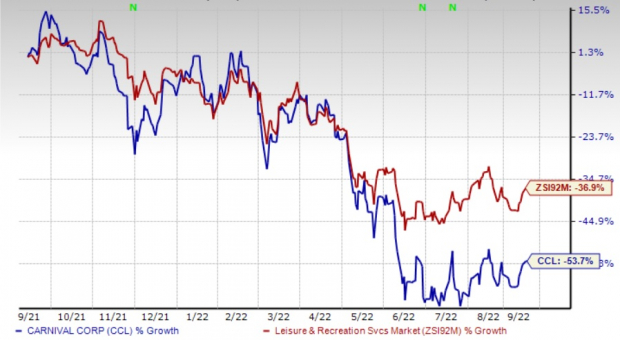

Shares of Carnival Company & plc CCL have plunged 53.7% up to now 12 months in contrast with the industry’s decline of 36.9%. Nonetheless, the inventory has displayed some resilience, growing 11.4% up to now three months. Improved reserving tendencies and resumption of operations are more likely to profit the corporate within the upcoming durations. Let’s delve deeper.

Progress Drivers

The corporate is benefiting from the resumption of operations and has returned to full operation. It said that greater than 90% of its capability is again in visitor cruise operations for third-quarter 2022. CCL expects to generate increased EBITDA in 2023 in contrast with 2019 on account of further capability and improved price construction. It anticipates adjusted EBITDA to be constructive for the third quarter of 2022.

The advance in bookings is aiding the corporate. In the course of the fiscal second quarter, the corporate raised its reserving place for the second half of 2022. Cumulative advance bookings for the second half of 2022 are under the historic vary. Carnival said that cumulative superior bookings for the primary half of 2023 are on the increased finish of historic ranges and elevated costs in contrast with the 2019 ranges. In the meantime, whole buyer deposits as of Might 31 had been $5.1 billion in contrast with $3.7 billion as of Feb 28, 2022. As of Jun 24, 2022, 91% of the corporate’s capability had resumed visitor cruise operations.

Picture Supply: Zacks Funding Analysis

Carnival focuses on fleet growth to drive development. Within the first quarter of fiscal 2022, the corporate introduced the addition of Costa Toscana, AIDAcosma and Discovery Princess to its fleet of environment friendly ships. It said that the addition of ships, coupled with the removing of much less environment friendly ships, is more likely to pave the trail for a 4% discount in ship stage unit price within the upcoming durations, thereby enhancing the highest and backside traces.

This Zacks Rank #3 (Maintain) firm is the most important and traditionally probably the most worthwhile cruise operator on this planet. The corporate’s cruise manufacturers are diversified throughout various geographies, together with Asia and Europe, and strategically positioned at varied worth factors throughout the bigger North American cruise market. This permits the corporate to cater to passengers in varied geographic areas and throughout the up to date, premium and luxurious cruise segments. With the power and variety of its manufacturers and itineraries, the corporate boasts a broader passenger base amongst potential and repeat cruise vacationers.

Key Picks

Some better-ranked shares within the Zacks Consumer Discretionary sector are Marriott Holidays Worldwide Company VAC, Alternative Inns Worldwide, Inc. CHH and Hyatt Inns Company H.

Marriott Holidays at the moment sports activities a Zacks Rank #1 (Robust Purchase). VAC has a trailing four-quarter earnings shock of 13.9%, on common. The inventory has declined 5.9% up to now 12 months. You possibly can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for VAC’s present monetary 12 months gross sales and EPS signifies a rise of 19.7% and 131.4%, respectively, from the year-ago interval’s reported ranges.

Alternative Inns carries a Zacks Rank #2 (Purchase), at current. CHH has a trailing four-quarter earnings shock of 11.2%, on common. The inventory has decreased 14.1% up to now six months.

The Zacks Consensus Estimate for CHH’s present monetary 12 months gross sales and EPS signifies development of 25.3% and 21.7%, respectively, from the year-ago interval’s reported ranges.

Hyatt Inns at the moment carries a Zacks Rank #2. H has a trailing four-quarter earnings shock of 11.2%, on common. The inventory has gained 25.3% up to now 12 months.

The Zacks Consensus Estimate for H’s present monetary 12 months gross sales and EPS signifies development of 21.9% and 21.7%, respectively, from the year-ago interval’s reported ranges.

5 Shares Set to Double

Every was handpicked by a Zacks knowledgeable because the #1 favourite inventory to realize +100% or extra in 2021. Earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

A lot of the shares on this report are flying beneath Wall Road radar, which offers an ideal alternative to get in on the bottom flooring.Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carnival Corporation (CCL): Free Stock Analysis Report

Hyatt Hotels Corporation (H): Free Stock Analysis Report

Choice Hotels International, Inc. (CHH): Free Stock Analysis Report

Marriot Vacations Worldwide Corporation (VAC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.

Source link