Rovio Leisure Oyj (HEL:ROVIO) provides €148m in market cap and insiders have a 43% stake in that achieve

Key Insights

- Vital insider management over Rovio Leisure Oyj implies vested pursuits in firm development

- The highest 6 shareholders personal 53% of the corporate

- own 29% of Rovio Entertainment Oyj

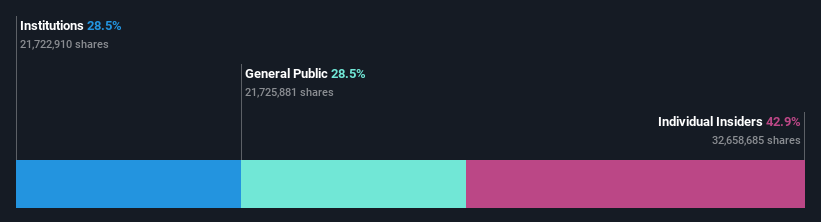

A have a look at the shareholders of Rovio Leisure Oyj (HEL:ROVIO) can inform us which group is strongest. The group holding essentially the most variety of shares within the firm, round 43% to be exact, is particular person insiders. Put one other means, the group faces the utmost upside potential (or draw back danger).

Clearly, insiders benefitted essentially the most after the corporate’s market cap rose by €148m final week.

Let’s take a better look to see what the various kinds of shareholders can inform us about Rovio Leisure Oyj.

Check out our latest analysis for Rovio Entertainment Oyj

What Does The Institutional Possession Inform Us About Rovio Leisure Oyj?

Establishments usually measure themselves in opposition to a benchmark when reporting to their very own traders, so that they usually develop into extra enthusiastic a few inventory as soon as it is included in a significant index. We might anticipate most corporations to have some establishments on the register, particularly if they’re rising.

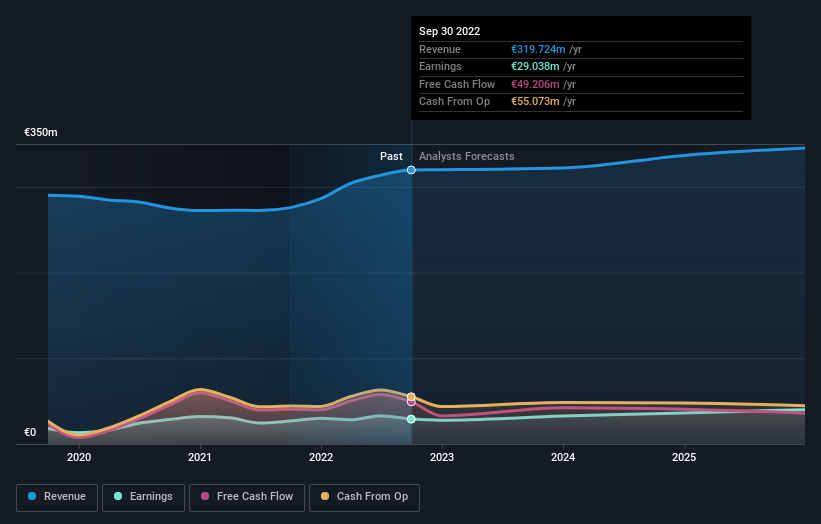

As you’ll be able to see, institutional traders have a good quantity of stake in Rovio Leisure Oyj. This could point out that the corporate has a sure diploma of credibility within the funding group. Nonetheless, it’s best to be cautious of counting on the supposed validation that comes with institutional traders. They too, get it mistaken typically. When a number of establishments personal a inventory, there’s all the time a danger that they’re in a ‘crowded commerce’. When such a commerce goes mistaken, a number of events might compete to promote inventory quick. This danger is increased in an organization with no historical past of development. You may see Rovio Leisure Oyj’s historic earnings and income beneath, however bear in mind there’s all the time extra to the story.

Rovio Leisure Oyj isn’t owned by hedge funds. The corporate’s largest shareholder is Kaj Hed, with possession of 17%. The second and third largest shareholders are Camilla Hed-Wilson and Jonathan Ole Hed, with an equal quantity of shares to their identify at 8.5%.

On additional inspection, we discovered that greater than half the corporate’s shares are owned by the highest 6 shareholders, suggesting that the pursuits of the bigger shareholders are balanced out to an extent by the smaller ones.

Whereas learning institutional possession for an organization can add worth to your analysis, it is usually a very good observe to analysis analyst suggestions to get a deeper perceive of a inventory’s anticipated efficiency. Fairly a number of analysts cowl the inventory, so you can look into forecast development fairly simply.

Insider Possession Of Rovio Leisure Oyj

Whereas the exact definition of an insider may be subjective, nearly everybody considers board members to be insiders. Administration in the end solutions to the board. Nonetheless, it isn’t unusual for managers to be government board members, particularly if they’re a founder or the CEO.

Most contemplate insider possession a constructive as a result of it could point out the board is effectively aligned with different shareholders. Nonetheless, on some events an excessive amount of energy is concentrated inside this group.

Our info means that insiders preserve a big holding in Rovio Leisure Oyj. Insiders have a €251m stake on this €586m enterprise. We might say this reveals alignment with shareholders, however it’s price noting that the corporate remains to be fairly small; some insiders might have based the enterprise. You may click here to see if those insiders have been buying or selling.

Normal Public Possession

Most of the people– together with retail traders — personal 29% stake within the firm, and therefore cannot simply be ignored. Whereas this dimension of possession is probably not sufficient to sway a coverage determination of their favour, they will nonetheless make a collective affect on firm insurance policies.

Subsequent Steps:

It is all the time price serious about the totally different teams who personal shares in an organization. However to grasp Rovio Leisure Oyj higher, we have to contemplate many different elements. Working example: We have noticed 2 warning signs for Rovio Entertainment Oyj you have to be conscious of, and 1 of them cannot be ignored.

If you happen to would favor uncover what analysts are predicting when it comes to future development, don’t miss this free report on analyst forecasts.

NB: Figures on this article are calculated utilizing knowledge from the final twelve months, which discuss with the 12-month interval ending on the final date of the month the monetary assertion is dated. This is probably not in line with full yr annual report figures.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not Rovio Leisure Oyj is doubtlessly over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free AnalysisHave suggestions on this text? Involved in regards to the content material? Get in touch with us straight. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We intention to convey you long-term targeted evaluation pushed by elementary knowledge. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Source link