Why Melco Resorts & Leisure Restricted (NASDAQ:MLCO) May Be Price Watching

Melco Resorts & Leisure Restricted (NASDAQ:MLCO), may not be a big cap inventory, but it surely acquired numerous consideration from a considerable worth enhance on the NASDAQGS over the previous few months. With many analysts masking the mid-cap inventory, we could count on any price-sensitive bulletins have already been factored into the inventory’s share worth. However what if there’s nonetheless a possibility to purchase? Let’s study Melco Resorts & Leisure’s valuation and outlook in additional element to find out if there’s nonetheless a discount alternative.

See our latest analysis for Melco Resorts & Entertainment

Is Melco Resorts & Leisure Nonetheless Low cost?

Excellent news, traders! Melco Resorts & Leisure continues to be a discount proper now. My valuation mannequin reveals that the intrinsic worth for the inventory is $17.68, which is above what the market is valuing the corporate in the mean time. This means a possible alternative to purchase low. Though, there could also be one other probability to purchase once more sooner or later. It is because Melco Resorts & Leisure’s beta (a measure of share worth volatility) is excessive, which means its worth actions will probably be exaggerated relative to the remainder of the market. If the market is bearish, the corporate’s shares will doubtless fall by greater than the remainder of the market, offering a main shopping for alternative.

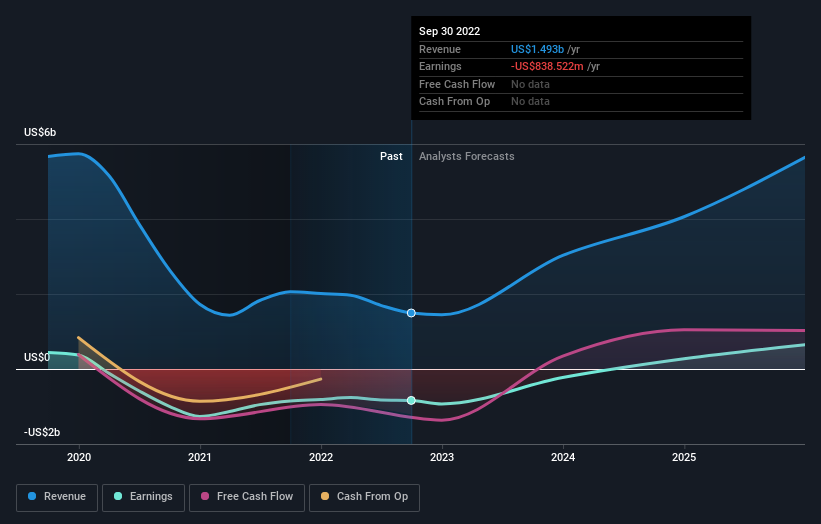

Can we count on development from Melco Resorts & Leisure?

Future outlook is a crucial facet while you’re looking to buy a inventory, particularly if you’re an investor searching for development in your portfolio. Though worth traders would argue that it’s the intrinsic worth relative to the value that matter essentially the most, a extra compelling funding thesis can be excessive development potential at an inexpensive worth. Within the upcoming 12 months, Melco Resorts & Leisure’s earnings are anticipated to extend by 52%, indicating a extremely optimistic future forward. This could result in extra sturdy money flows, feeding into a better share worth.

What This Means For You

Are you a shareholder? Since MLCO is at present undervalued, it might be a good time to extend your holdings within the inventory. With an optimistic outlook on the horizon, it looks as if this development has not but been totally factored into the share worth. Nonetheless, there are additionally different elements akin to capital construction to contemplate, which may clarify the present undervaluation.

Are you a possible investor? In case you’ve been keeping track of MLCO for some time, now could be the time to enter the inventory. Its buoyant future outlook isn’t totally mirrored within the present share worth but, which implies it’s not too late to purchase MLCO. However earlier than you make any funding selections, contemplate different elements akin to the power of its steadiness sheet, as a way to make a well-informed purchase.

So whereas earnings high quality is essential, it is equally essential to contemplate the dangers going through Melco Resorts & Leisure at this time limit. At Merely Wall St, we discovered 2 warning signs for Melco Resorts & Entertainment and we predict they deserve your consideration.

If you’re not involved in Melco Resorts & Leisure, you should use our free platform to see our record of over 50 other stocks with a high growth potential.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Melco Resorts & Leisure is probably over or undervalued by trying out our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free AnalysisHave suggestions on this text? Involved concerning the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We goal to deliver you long-term targeted evaluation pushed by basic information. Be aware that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Source link