Is Pets at Residence Group (LON:PETS) A Dangerous Funding?

Some say volatility, quite than debt, is the easiest way to consider threat as an investor, however Warren Buffett famously stated that ‘Volatility is way from synonymous with threat.’ So it appears the sensible cash is aware of that debt – which is often concerned in bankruptcies – is an important issue, while you assess how dangerous an organization is. We be aware that Pets at Residence Group Plc (LON:PETS) does have debt on its stability sheet. However ought to shareholders be anxious about its use of debt?

Why Does Debt Carry Threat?

Debt assists a enterprise till the enterprise has hassle paying it off, both with new capital or with free money move. Within the worst case state of affairs, an organization can go bankrupt if it can’t pay its collectors. Nevertheless, a extra frequent (however nonetheless painful) state of affairs is that it has to lift new fairness capital at a low value, thus completely diluting shareholders. In fact, loads of corporations use debt to fund progress, with none unfavorable penalties. After we take into consideration an organization’s use of debt, we first take a look at money and debt collectively.

See our latest analysis for Pets at Home Group

What Is Pets at Residence Group’s Debt?

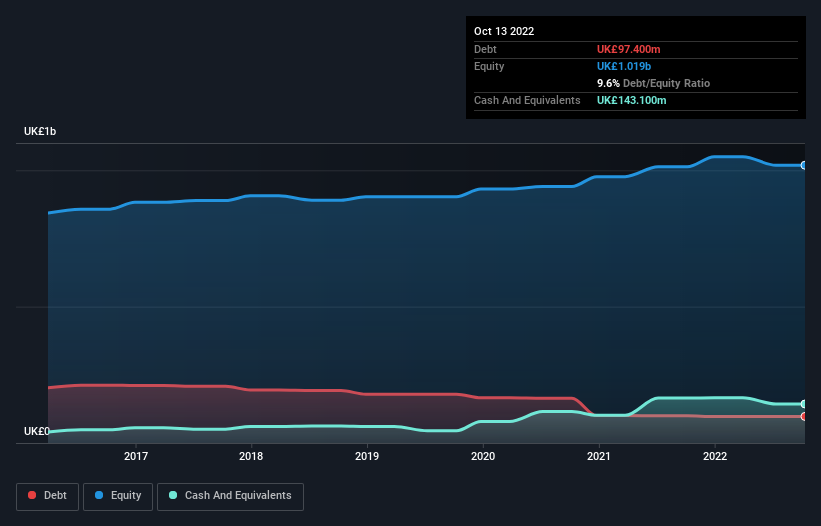

The chart beneath, which you’ll click on on for larger element, exhibits that Pets at Residence Group had UK£97.4m in debt in October 2022; about the identical because the 12 months earlier than. Nevertheless, it does have UK£143.1m in money offsetting this, resulting in internet money of UK£45.7m.

A Look At Pets at Residence Group’s Liabilities

In line with the final reported stability sheet, Pets at Residence Group had liabilities of UK£345.3m due inside 12 months, and liabilities of UK£463.2m due past 12 months. Offsetting these obligations, it had money of UK£143.1m in addition to receivables valued at UK£63.6m due inside 12 months. So it has liabilities totalling UK£601.8m greater than its money and near-term receivables, mixed.

This deficit is not so unhealthy as a result of Pets at Residence Group is value UK£1.48b, and thus may in all probability increase sufficient capital to shore up its stability sheet, if the necessity arose. Nevertheless, it’s nonetheless worthwhile taking a detailed take a look at its potential to repay debt. Regardless of its noteworthy liabilities, Pets at Residence Group boasts internet money, so it is truthful to say it doesn’t have a heavy debt load!

Additionally good is that Pets at Residence Group grew its EBIT at 11% over the past 12 months, additional growing its potential to handle debt. There is not any doubt that we be taught most about debt from the stability sheet. However finally the long run profitability of the enterprise will determine if Pets at Residence Group can strengthen its stability sheet over time. So if you wish to see what the professionals assume, you would possibly discover this free report on analyst profit forecasts to be fascinating.

However our closing consideration can be essential, as a result of an organization can’t pay debt with paper earnings; it wants chilly arduous money. Whereas Pets at Residence Group has internet money on its stability sheet, it is nonetheless value looking at its potential to transform earnings earlier than curiosity and tax (EBIT) to free money move, to assist us perceive how rapidly it’s constructing (or eroding) that money stability. Fortunately for any shareholders, Pets at Residence Group truly produced extra free money move than EBIT over the past three years. There’s nothing higher than incoming money in terms of staying in your lenders’ good graces.

Summing Up

Whereas Pets at Residence Group does have extra liabilities than liquid belongings, it additionally has internet money of UK£45.7m. And it impressed us with free money move of UK£143m, being 153% of its EBIT. So we do not assume Pets at Residence Group’s use of debt is dangerous. There is not any doubt that we be taught most about debt from the stability sheet. Nevertheless, not all funding threat resides inside the stability sheet – removed from it. Remember that Pets at Home Group is showing 1 warning sign in our investment analysis , it’s best to learn about…

When all is alleged and finished, generally its simpler to deal with corporations that do not even want debt. Readers can entry a list of growth stocks with zero net debt 100% free, proper now.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not Pets at Residence Group is probably over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free AnalysisHave suggestions on this text? Involved in regards to the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We goal to deliver you long-term targeted evaluation pushed by basic knowledge. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Source link