Bootstrapping fundamentals, fintech’s future, tech employers acquire benefit • TechCrunch

Are you planning to play League of Legends throughout your subsequent investor pitch? (In that case, studying this most likely isn’t a great use of your time.)

For founders who’re eager about constructing on their very own, sustaining management and staying off the fundraising treadmill for so long as doable, investor/entrepreneur Marjorie Radlo-Zandi units out five basic principles for bootstrapped founders in her newest TC+ article.

It’s not for everybody: Self-funded firms will ask extra from their staff than bigger operations that provide free lunches and different perks. At one bootstrapped startup the place I labored, I used to be requested to defer a part of my wage — after I used to be employed.

Full TechCrunch+ articles are solely accessible to members.

Use discount code TCPLUSROUNDUP to avoid wasting 20% off a one- or two-year subscription.

Radlo-Zandi covers the fundamentals with regard to hiring, managing bills and shaping firm tradition, however she additionally urges self-funders to tamp down expectations and take a measured strategy:

“Don’t be tempted to hop on a aircraft at a second’s discover to fulfill potential clients in glamorous areas or for conferences in far-flung areas,” she writes. “Your bootstrapped enterprise possible is not going to survive such huge, non-compulsory monetary outlays.”

Bootstrapped founders face longer odds, but when they will drive development and attain product-market match, “fundraising shall be that a lot simpler.”

Thanks very a lot for studying,

Walter Thompson

Editorial Supervisor, TechCrunch+

@yourprotagonist

The ability pendulum is swinging again to employers, isn’t it?

Picture Credit: AOosthuizen (opens in a new window) / Getty Photographs

Greater than 120,000 tech employees have misplaced jobs to this point this 12 months, in accordance with layoffs.fyi. With greater than a fifth of these layoffs happening in November, many from well-capitalized public firms, it’s straightforward to see why Continuum CEO Nolan Church believes that is the start of a wave.

“During the last 12 years, the pendulum between who has energy between staff and employers has drastically swung towards staff,” he mentioned final week on the TechCrunch Fairness podcast.

“Now, we’re in a second the place the pendulum is swinging again.”

Solutions for H-1B employees who’ve been laid off (or suppose they is perhaps)

Picture Credit: Klaus Vedfelt (opens in a new window) / Getty Photographs

Sophie Alcorn, an immigration legislation legal professional based mostly in Silicon Valley, estimates that 15% of the folks lately laid off from Bay Space startups are immigrants, 90% of whom are H-1B holders.

For those who’re a visa holder who’s been laid off, your first precedence is to “determine your final day of employment, as a result of that’s when it is advisable to begin counting the 60-day grace interval,” says Alcorn.

“You both get a brand new job, you allow or you determine another technique to legally keep in the USA, however it’s a must to take some motion inside these 60 days.”

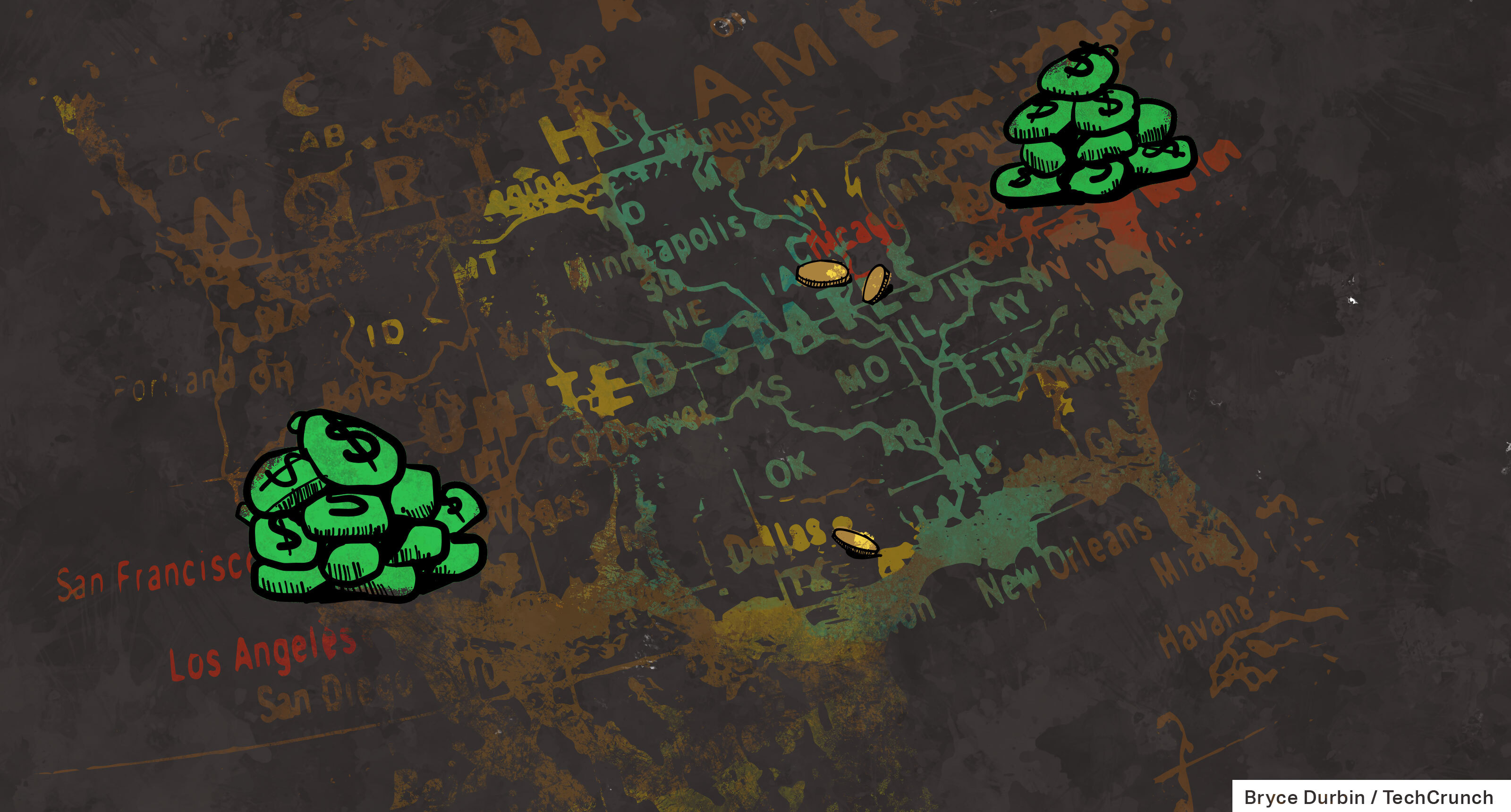

Almost 80% of enterprise funds raised in simply two states as US LPs retreat to the coasts

Picture Credit: Bryce Durbin / TechCrunch

After the pandemic started, there was lots of buzz about how enterprise capital was shifting away from its roots in San Francisco and New York to make inroads into the Midwest.

However after an prolonged hunch in public markets led so many buyers to sit down on the sidelines, information present that “most funds outdoors of the 2 largest startup hubs … are feeling the frost from potential LPs,” stories Rebecca Szkutak.

“Thus far this 12 months, 77% of capital has been raised in simply California and New York. In 2021, these states raised 68% of the 12 months’s totals.”

Getting ready for fintech’s second decade: 4 strikes your agency should make now

Picture Credit: Emilija Manevska (opens in a new window) / Getty Photographs

In line with guide Grant Easterbrook, fintech startups that hope to succeed over the subsequent few years should be ready to go up towards:

- Main banks and monetary service suppliers with loyalty packages and “tremendous apps.”

- Rising DeFi protocols “that may supply monetary merchandise that contain real-world property.”

- Banking, invoicing, lending, funds and accounting packaged as “embedded monetary merchandise.”

- A number of international locations issuing their very own central financial institution digital foreign money (CBDC).

“Your agency will want a really sturdy worth proposition to compete with all 4 varieties of rivals,” writes Easterbrook, who shares his concepts for navigating the subsequent decade of fintech in a TC+ visitor publish.

Source link