Meals tech: satisfying traders’ urge for food for development?

Amid all of the noise within the markets you may need missed a small information merchandise that an eagerly-anticipated new fund launch had been “paused”.

The Sustainable Farmland Belief was as a consequence of record a few days in the past on the London market. It could have been the primary UK-listed fund investing in high-quality, extremely productive US farmland.

Meals continues to be within the information, however in fact something food-related on the inventory markets has had a troublesome time of late — regardless of all these worries about feeding the world. The commodity core of the meals market — grains, for instance — has seen costs drop again after sharp will increase, whereas the attractive bit, foodtech, has skilled a inventory market massacre — as I do know via operating a meals tech weblog (FutureFoodFinance).

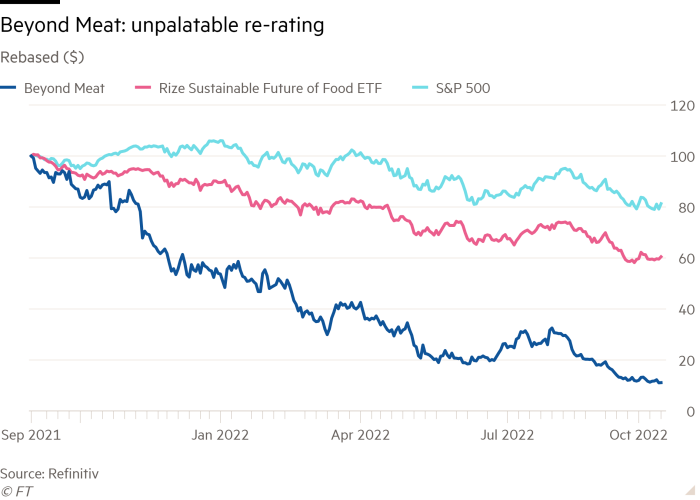

Meals supply corporations, from the likes of Ocado and transferring via all of the Deliveroos and Simply Eats, have seen their share costs massacred. A logo of the brutal re-rating has been Beyond Meat, the doyen of all issues various plant-based meat. Its shares have collapsed by practically 80 per cent because the starting of the 12 months. It has suffered a string of “challenges” not least the departure of the chief operating officer after he was allegedly concerned in a battle; and dismal take-up in quick meals eating places within the US (much less so in Europe) of its pretend burgers.

Not unsurprisingly, these curators of skilled opinion, the worldwide consultancies, have turned tail and admitted that possibly various proteins won’t be such an enormous factor in spite of everything. As Deloitte pronounced: “The addressable market could also be extra restricted than many thought.” Personally, I discovered a small information story far more fascinating, specifically that meals big JBS has pulled the plug on a brand new plant protein manufacturing facility in Denver, which solely opened late final 12 months.

So if the majors are pulling the plug, does that imply it’s recreation over for all of the rising intelligent meals applied sciences?

Possibly. However I feel there are some actually fascinating initiatives rising that don’t reduce via to a wider investor viewers, what with the noise about sell-offs.

First, the centre of gravity for various proteins, be they plant-based or grown in a vat (cultured meat) is transferring inexorably in the direction of Asia.

Singapore is pushing forward with new applied sciences and you may already purchase (costly) fast-food rooster grown in a bioreactor.

Asia has woken as much as the necessity for brand spanking new concepts and higher safety in meals — one current report (by Roots Evaluation) noticed that annual mental property filings for plant-based meat has grown greater than 3 times over the previous decade, with greater than half of mental property paperwork originating from Asian-based corporations.

If I had been searching for a future for plant-based meat options it could be in China. It’s noticeable that even in cultured meat (meat grown in a lab), enterprise capital companies together with the Intention-listed meals enterprise capital fund Agronomics are more and more turning their consideration to Asian-based companies.

I’d additionally hold a beady eye on the regulators within the US approving cultured meat-based options to plant-based merchandise — particularly these involving tuna. This might come as early as subsequent 12 months and spark a land seize as different start-ups launch merchandise involving different fish options.

However, for me, probably the most fascinating broad house in meals is what’s referred to as agtech, or, extra particularly, vertical farming, organic options to pesticides, plant biotech and seeds and farm automation.

Let’s take every in flip. US-listed AppHarvest is one in all a number of companies swarming into managed agriculture, be that next-generation greenhouses or city-based vertical farms.

Having initially targeted on high-margin leafy greens, corporations are already switching to fruit (strawberries) and even tree saplings.

The Scottish authorities’s forestry company just lately introduced that it goals to develop thousands and thousands of saplings indoors earlier than transferring them to the wild. Nevertheless it’s Asia it’s essential to watch in vertical and closed-environment farming, particularly metropolis states with little farmland — Center Jap cities and Singapore.

Subsequent, the battle to exchange artificial pesticides and herbicides is rushing up, helped by governments all over the world calling for motion.

The large boys are already piling in: Syngenta, as an example, just lately acquired Valagro, a serious participant in these applied sciences, and is now busily positioning itself in a promote it reckons might hit $10bn by 2030.

Syngenta says that fashionable built-in pest administration (IPM) methods, which mix pheromones and different management strategies with artificial sprays, may work higher. Up towards these giants you’ll additionally discover smaller gamers, together with UK-listed Eden Analysis, which can also be creating biopesticides.

Plant biotech can also be value a glance, alongside seeds extra typically. Regulate US big Corteva, spun out of Du Pont. This US enterprise has historically made a lot of its cash from corn seed however is now creating new applied sciences together with utilizing AI to develop plant biotech processes that enable seeds to adapt to altering climates.

Scientists have already used DeepMind, the UK-based synthetic intelligence firm, to engineer potatoes higher suited to outlive hotter climates. Sitting alongside this expertise and utilizing lots of the identical genetic engineering instruments, is the event of biomaterials, led by companies reminiscent of US-listed Gingko Bioworks.

The standout for me? Spider silk protein made by Spiber and AMSilk, the business leaders, has grown in manufacturing extremely quick since 2008, though it nonetheless totals simply eight tonnes presently.

Lastly, there’s the inevitable automation of farms, powered growing price inflation, greying farm homeowners and insufficient provide of farm employees.

Typical of this push is the remorseless rise of robotic strawberry-picking machines that are beginning to emerge in specialist farms. If you’d like one gauge of why this issues think about the current announcement by US big John Deere that it plans to go autonomous with driverless tractors and different machines. It would set up large numbers of sensors dotted round a farm, integrating info flows into massive knowledge dashboards, after which utilizing that knowledge to allow extra automation.

Some perspective is required — in accordance with Deere, the worldwide fleet of its autonomous tractors is lower than 50 at this time however the US agency plans to have a completely autonomous farming system for row crops in place by 2030.

Lastly, I feel that in just about each subsector in agtech will probably be the present massive gamers, practically all of that are publicly listed, that seize the dominant market share.

For the smaller corporations the problem is to scale up rapidly sufficient, with sufficient money within the financial institution, to allow them to be purchased by greater corporations reminiscent of Deere and Corteva.

That additionally spells loads of M&A exercise that can profit specialist enterprise capitalists — watch this house as agtech enterprise capitalists and vertical farming specialists look to record their funds on the London market as soon as sentiment stabilises. And be careful for Sustainable Farmland Belief. I’m certain they are going to be again as investing in extremely productive, high-quality US farmland might be one of many most secure bets in a world of upper inflation.

David Stevenson is an lively non-public investor. Electronic mail: adventurous@ft.com. Twitter: @advinvestor

Source link