Is Amazon Inventory A Purchase Forward Of The Vacation Buying Season? (NASDAQ:AMZN)

georgeclerk

Thesis

Amazon.com, Inc. (NASDAQ:AMZN) is a big and complicated enterprise that spans e-commerce, cloud, promoting, and extra. Whereas this text focuses totally on the e-commerce enterprise and its cyclicality, I price Amazon as a purchase principally as a consequence of its robust cloud and promoting companies that are experiencing quicker development and have larger margins.

How Does Amazon Inventory Carry out Throughout The Vacation Season?

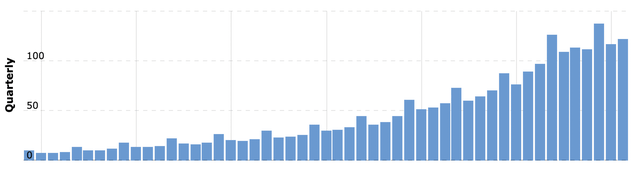

MacroTrends

The above chart reveals Amazon’s quarterly income. One factor that ought to leap out is that after each 4 quarters, there’s a big bump which subsides the next quarter. This bump is because of larger spending in the course of the vacation purchasing season in This fall.

Amazon usually receives an analogous bump in money stream in This fall; in a few years, Amazon’s free money stream was detrimental for 3 quarters however closely optimistic in This fall.

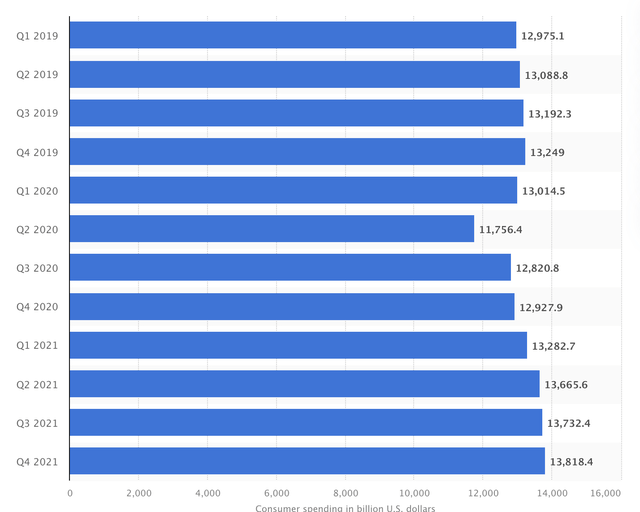

Statistica

This bump is mirrored within the above chart, which reveals quarterly shopper spending developments within the USA going again to 2019. This fall all the time instructions essentially the most spending, though the bump on this chart is much less pronounced than in Amazon’s chart and the pattern is disrupted by Covid in 2020.

Like different massive retailers together with Walmart (WMT), Amazon has traditionally been profitable at capturing a big a part of shoppers’ vacation spending by aggressive promoting and reductions. That technique has served the corporate effectively, as evidenced by its constant This fall income bump.

Amazon is kicking off the vacations early this yr, with an early access sale for Prime members on October 11 and 12. This seems to be a pattern this yr, as Walmart, Kohl’s (KSS), Macy’s (M), Mattress Bathtub & Past (BBBY), Goal (TGT), and Greatest Purchase (BBY) are all holding “vacation” gross sales in early October as effectively. I went to Dwelling Depot the opposite day and even that they had a Christmas part arrange by October.

Buying occasions are shifting earlier this yr as a result of spending in the course of the holidays is anticipated to be weaker as a consequence of inflation and different macroeconomic points. Per Adobe Analytics, on-line gross sales are solely anticipated to rise 2.5% in November and December this yr, in comparison with 8.6% final yr. This would be the slowest improve since 2015.

With fewer {dollars} to go round, retailers are preventing more durable for his or her share of consumers’ wallets, and the sooner they throw their hat within the ring, the extra doubtless they’re to come back out with their fair proportion. A few of these retailers are presently coping with stock points as effectively, and discounting gadgets now will assist them transfer the surplus stock sooner. Adobe Analytics expects electronics to be discounted by a mean of 27% this yr, in contrast with 8% final yr, partially as a consequence of stock points.

Though Amazon all the time generates essentially the most income in This fall, that does not imply that its inventory all the time performs greatest in This fall. Over the previous 5 years, AMZN inventory has a mean This fall return of three.2%. That is in comparison with a mean annual return of 37% between 2017 and 2021 for AMZN inventory. So whereas the returns have been optimistic, traders should not anticipate the perfect returns in This fall simply because Amazon generates essentially the most income in This fall. Development is often checked out on a year-over-year foundation, so every This fall is in comparison with the robust This fall within the prior yr relatively than the Q3 within the present yr.

Why Has Amazon’s Inventory Worth Been Dropping?

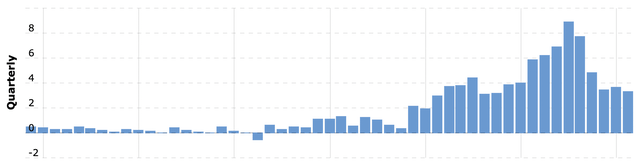

MacroTrends

Whereas aggressive selling and discounting to drive income development has been a profitable technique for Amazon prior to now, the impression to the underside line was much less pronounced. As proven within the chart above, Amazon’s quarterly working earnings usually sees a bump each fourth quarter, however the pattern is far much less constant in comparison with the income bump.

Actually, the height in direction of the fitting of the graph really occurred in Q1 of 2021, and working earnings has been declining since then, together with in This fall of 2021. It has been even worse for money stream, as Amazon’s free money stream went detrimental in 2021 for the primary time in over a decade. This decline has been one main purpose why Amazon inventory peaked in July of 2021 and fell 40% since then.

After all, there have been different points that contributed to the decline as effectively. The general market is down greater than 25% this yr, and whereas Amazon has traditionally outperformed the market, it is troublesome to generate profitable returns within the face of a market crash. Amazon’s income development has additionally slowed this yr to its slowest price since at the very least 2010 because it laps troublesome Covid comps.

Is AMZN Inventory A Purchase, Promote, Or Maintain?

Within the brief time period, the best-case situation for Amazon is that working earnings expands materially in This fall as a consequence of a profitable vacation season. This has occurred prior to now; for instance, in 2014 Amazon’s working earnings would have been detrimental if not for This fall, however after reporting a powerful This fall, Amazon inventory rose 27% in Q1 of the next yr when it reported outcomes.

After all, with demand showing weak and Amazon’s opponents aggressively discounting as a consequence of stock points, it is also doable that Amazon won’t have a powerful This fall. The general market may proceed to dump, and cyclical shopper manufacturers like Amazon may proceed to obtain the worst of the selloff. If the corporate will get overly aggressive with its reductions, it may proceed to expertise declining working margins as effectively.

Within the brief time period, it is anybody’s guess as to how AMZN inventory will carry out. Not solely is it troublesome to foretell the power of the vacation purchasing season and its impression on Amazon’s high and backside line, however even when one have been to appropriately predict that, it does not assure that AMZN inventory will transfer in the identical path as Amazon’s enterprise metrics within the brief time period. Market volatility can outweigh precise earnings outcomes for months and even years.

In the long run, I am cautiously optimistic that Amazon can get again on monitor. That is principally because of its AWS and promoting segments, that are much less cyclical than the e-commerce enterprise and still have larger margins and quicker development. I’ve lined these segments extra in previous articles, however in brief, I imagine that these segments will drive vital free money stream and working earnings development for Amazon within the coming years. That is based mostly on my perspective as a software program engineer, understanding the place cloud computing is now and the place it could possibly be in 10 years.

Monetary analysts agree, as in line with In search of Alpha the typical analyst expects a ahead P/E of 8 for Amazon in 2031. That is in comparison with 9 for Microsoft, 12 for Apple, 11 for Walmart, and 15 for Costco. Whereas Amazon has the very best P/E of the group now, it is anticipated to see the quickest backside line development and in the end have the bottom P/E in a decade.

That potential makes Amazon a purchase in the present day, so long as traders can abdomen investing in an organization which is presently much less worthwhile and fewer shareholder-friendly than its large tech and large retail friends.

Conclusion

Within the worth targets that I share with Tech Investing Edge members, I even have a lower cost goal for Amazon relative to a few of its large tech friends, regardless that I view it as having the very best uncertainty of the group. Whereas I share analysts’ optimism about Amazon’s capability to increase its revenue margin over the following decade, I additionally view the present lack of excessive profitability, development, and shareholder returns as a danger. Whereas I price AMZN inventory as a purchase going into the vacation season as a result of I do have a worth goal that means market-beating returns for the inventory within the coming years, I’d additionally encourage traders to think about growing publicity to different large tech firms earlier than taking a look at Amazon.

Source link