We Ran A Inventory Scan For Earnings Development And World Wrestling Leisure (NYSE:WWE) Handed With Ease

For rookies, it may possibly seem to be a good suggestion (and an thrilling prospect) to purchase an organization that tells an excellent story to traders, even when it presently lacks a monitor file of income and revenue. However as Peter Lynch stated in One Up On Wall Road, ‘Lengthy pictures nearly by no means repay.’ A loss-making firm is but to show itself with revenue, and finally the influx of exterior capital could dry up.

So if this concept of excessive threat and excessive reward does not go well with, you is perhaps extra thinking about worthwhile, rising firms, like World Wrestling Leisure (NYSE:WWE). Whereas this does not essentially converse as to if it is undervalued, the profitability of the enterprise is sufficient to warrant some appreciation – particularly if its rising.

See our latest analysis for World Wrestling Entertainment

World Wrestling Leisure’s Enhancing Earnings

World Wrestling Leisure has undergone an enormous progress in earnings per share over the past three years. A lot in order that this three 12 months progress fee would not be a good evaluation of the corporate’s future. Consequently, we’ll zoom in on progress over the past 12 months, as an alternative. In spectacular style, World Wrestling Leisure’s EPS grew from US$1.69 to US$2.97, over the earlier 12 months. It isn’t typically an organization can obtain year-on-year progress of 75%.

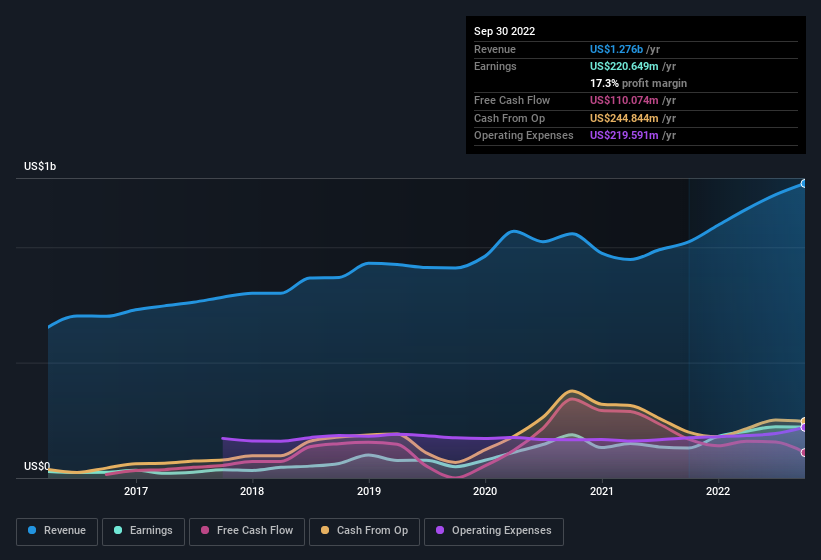

One option to double-check an organization’s progress is to have a look at how its income, and earnings earlier than curiosity and tax (EBIT) margins are altering. World Wrestling Leisure maintained steady EBIT margins over the past 12 months, all whereas rising income 25% to US$1.3b. That is an actual constructive.

You possibly can check out the corporate’s income and earnings progress pattern, within the chart beneath. To see the precise numbers, click on on the chart.

You do not drive along with your eyes on the rear-view mirror, so that you is perhaps extra on this free report showing analyst forecasts for World Wrestling Entertainment’s future profits.

Are World Wrestling Leisure Insiders Aligned With All Shareholders?

Seeing insiders proudly owning a big portion of the shares on problem is usually an excellent signal. Their incentives might be aligned with the traders and there is much less of a likelihood in a sudden sell-off that might influence the share value. So we’re happy to report that World Wrestling Leisure insiders personal a significant share of the enterprise. In truth, they personal 43% of the shares, making insiders a really influential shareholder group. Those that are comforted by stable insider possession like this ought to be blissful, because it implies that these operating the enterprise are genuinely motivated to create shareholder worth. And their holding is extraordinarily worthwhile on the present share value, totalling US$2.7b. That degree of funding from insiders is nothing to sneeze at.

It means quite a bit to see insiders invested within the enterprise, however shareholders could also be questioning if remuneration insurance policies are of their finest curiosity. Our fast evaluation into CEO remuneration would appear to point they’re. The median complete compensation for CEOs of firms comparable in measurement to World Wrestling Leisure, with market caps between US$4.0b and US$12b, is round US$8.0m.

World Wrestling Leisure’s CEO took house a complete compensation bundle value US$5.7m within the 12 months main as much as December 2021. That appears fairly cheap, particularly given it is beneath the median for comparable sized firms. Whereas the extent of CEO compensation should not be the largest think about how the corporate is considered, modest remuneration is a constructive, as a result of it means that the board retains shareholder pursuits in thoughts. Usually, arguments may be made that cheap pay ranges attest to good decision-making.

Is World Wrestling Leisure Value Holding An Eye On?

World Wrestling Leisure’s earnings per share have been hovering, with progress charges sky excessive. The sweetener is that insiders have a mountain of inventory, and the CEO remuneration is sort of cheap. The robust EPS enchancment suggests the companies is buzzing alongside. Huge progress could make large winners, so the writing on the wall tells us that World Wrestling Leisure is value contemplating rigorously. It is best to at all times take into consideration dangers although. Working example, we have noticed 1 warning sign for World Wrestling Entertainment you have to be conscious of.

The fantastic thing about investing is that you would be able to put money into nearly any firm you need. However for those who want to deal with shares which have demonstrated insider shopping for, right here is a list of companies with insider buying in the last three months.

Please word the insider transactions mentioned on this article check with reportable transactions within the related jurisdiction.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not World Wrestling Leisure is doubtlessly over or undervalued by trying out our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free AnalysisHave suggestions on this text? Involved concerning the content material? Get in touch with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to deliver you long-term centered evaluation pushed by elementary knowledge. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Source link