Pets at Dwelling Group Down 6.9% Regardless of Strong Earnings Progress

It’s exhausting to get excited after taking a look at Pets at Dwelling Group’s (LON:PETS) latest efficiency, when its inventory has declined 6.9% over the previous three months. Nonetheless, inventory costs are often pushed by an organization’s monetary efficiency over the long run, which on this case seems fairly promising. Significantly, we can be taking note of Pets at Home Group’s ROE at present.

Return on Fairness or ROE is a check of how successfully an organization is rising its worth and managing traders’ cash. Merely put, it’s used to evaluate the profitability of an organization in relation to its fairness capital.

See our latest analysis for Pets at Home Group

How Is ROE Calculated?

ROE might be calculated by utilizing the method:

Return on Fairness = Internet Revenue (from persevering with operations) ÷ Shareholders’ Fairness

So, primarily based on the above method, the ROE for Pets at Dwelling Group is:

11% = UK£112m ÷ UK£1.0b (Based mostly on the trailing twelve months to October 2022).

The ‘return’ is the quantity earned after tax over the past twelve months. That signifies that for each £1 value of shareholders’ fairness, the corporate generated £0.11 in revenue.

What Has ROE Received To Do With Earnings Progress?

So far, we now have discovered that ROE measures how effectively an organization is producing its income. We now want to judge how a lot revenue the corporate reinvests or “retains” for future progress which then provides us an concept in regards to the progress potential of the corporate. Usually talking, different issues being equal, corporations with a excessive return on fairness and revenue retention, have the next progress price than corporations that don’t share these attributes.

Pets at Dwelling Group’s Earnings Progress And 11% ROE

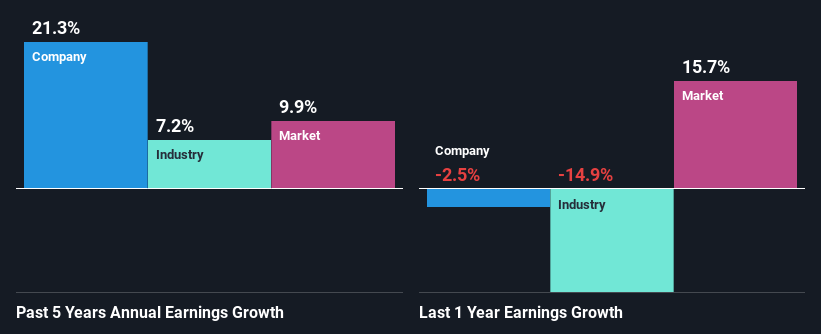

At first look, Pets at Dwelling Group appears to have a good ROE. But, the truth that the corporate’s ROE is decrease than the trade common of 18% does mood our expectations. Nonetheless, we’re happy to see the spectacular 21% internet earnings progress reported by Pets at Dwelling Group over the previous 5 years. We reckon that there may very well be different elements at play right here. For example, the corporate has a low payout ratio or is being managed effectively. Nonetheless, to not neglect, the corporate does have a good ROE to start with, simply that it’s decrease than the trade common. So this actually additionally offers some context to the excessive earnings progress seen by the corporate.

We then in contrast Pets at Dwelling Group’s internet earnings progress with the trade and we’re happy to see that the corporate’s progress determine is greater when put next with the trade which has a progress price of seven.2% in the identical interval.

The idea for attaching worth to an organization is, to a terrific extent, tied to its earnings progress. The investor ought to attempt to set up if the anticipated progress or decline in earnings, whichever the case could also be, is priced in. This then helps them decide if the inventory is positioned for a brilliant or bleak future. What’s PETS value at present? The intrinsic value infographic in our free research report helps visualize whether or not PETS is at present mispriced by the market.

Is Pets at Dwelling Group Effectively Re-investing Its Income?

The three-year median payout ratio for Pets at Dwelling Group is 49%, which is reasonably low. The corporate is retaining the remaining 51%. By the seems of it, the dividend is properly lined and Pets at Dwelling Group is reinvesting its income effectively as evidenced by its distinctive progress which we mentioned above.

Moreover, Pets at Dwelling Group has paid dividends over a interval of eight years which signifies that the corporate is fairly severe about sharing its income with shareholders. Our newest analyst information exhibits that the long run payout ratio of the corporate over the subsequent three years is anticipated to be roughly 56%. In consequence, Pets at Dwelling Group’s ROE is just not anticipated to alter by a lot both, which we inferred from the analyst estimate of 10% for future ROE.

Conclusion

In whole, we’re fairly proud of Pets at Dwelling Group’s efficiency. Significantly, we like that the corporate is reinvesting closely into its enterprise at a average price of return. Unsurprisingly, this has led to a powerful earnings progress. Having stated that, the corporate’s earnings progress is anticipated to decelerate, as forecasted within the present analyst estimates. To know extra in regards to the newest analysts predictions for the corporate, take a look at this visualization of analyst forecasts for the company.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Pets at Dwelling Group is doubtlessly over or undervalued by trying out our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free AnalysisHave suggestions on this text? Involved in regards to the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We goal to convey you long-term centered evaluation pushed by elementary information. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Source link