These Who Invested In Tongcheng Journey Holdings Three Years In the past Are Up 46%

By shopping for an index fund, buyers can approximate the typical market return. However for those who decide the appropriate particular person shares, you can make greater than that. Simply check out Tongcheng Journey Holdings Restricted (HKG:780), which is up 46%, over three years, soundly beating the market decline of 18% (not together with dividends). Then again, the returns have not been fairly so good not too long ago, with shareholders up simply 21%.

So let’s examine and see if the long term efficiency of the corporate has been in step with the underlying enterprise’ progress.

Check out our latest analysis for Tongcheng Travel Holdings

On condition that Tongcheng Journey Holdings did not make a revenue within the final twelve months, we’ll concentrate on income progress to type a fast view of its enterprise growth. Shareholders of unprofitable firms often count on robust income progress. As you may think about, quick income progress, when maintained, usually results in quick revenue progress.

Within the final 3 years Tongcheng Journey Holdings noticed its income develop at 2.7% per 12 months. That is not a really excessive progress charge contemplating it does not make income. The modest progress might be broadly mirrored within the share value, which is up 14%, per 12 months over 3 years. Finally, the vital factor is whether or not the corporate is trending to profitability. Given the market does not appear too excited concerning the inventory, a better take a look at the monetary information may repay, if you’ll find indications of a stronger progress development sooner or later.

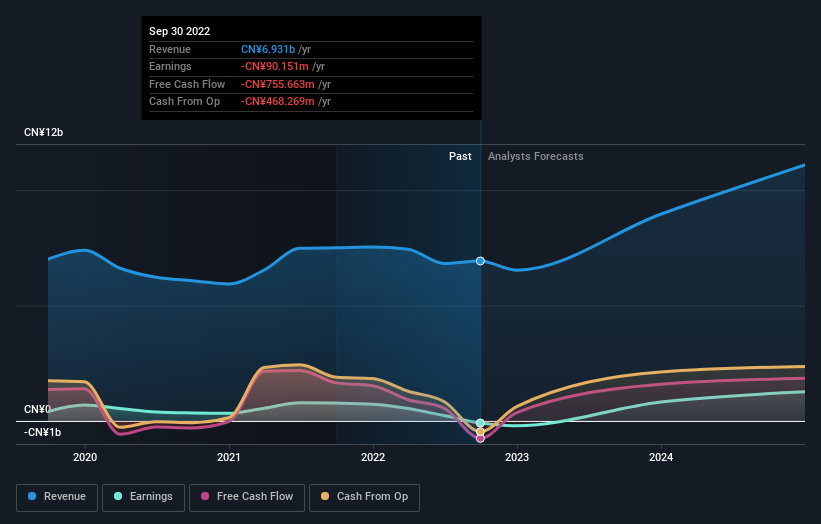

You may see under how earnings and income have modified over time (uncover the precise values by clicking on the picture).

Tongcheng Journey Holdings is a well-known inventory, with loads of analyst protection, suggesting some visibility into future progress. So it makes numerous sense to take a look at what analysts suppose Tongcheng Journey Holdings will earn in the future (free analyst consensus estimates)

A Completely different Perspective

Pleasingly, Tongcheng Journey Holdings’ complete shareholder return final 12 months was 21%. So this 12 months’s TSR was really higher than the three-year TSR (annualized) of 14%. Given the monitor document of stable returns over various time frames, it is perhaps value placing Tongcheng Journey Holdings in your watchlist. Shareholders may need to look at this detailed historical graph of previous earnings, income and money movement.

We’ll like Tongcheng Journey Holdings higher if we see some large insider buys. Whereas we wait, take a look at this free list of growing companies with considerable, recent, insider buying.

Please observe, the market returns quoted on this article replicate the market weighted common returns of shares that presently commerce on HK exchanges.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not Tongcheng Journey Holdings is probably over or undervalued by trying out our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free AnalysisHave suggestions on this text? Involved concerning the content material? Get in touch with us instantly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We goal to carry you long-term centered evaluation pushed by basic information. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Source link