Insider Shopping for: The Dave & Buster’s Leisure, Inc. (NASDAQ:PLAY) Senior VP and Chief Expertise & Info Officer Simply Purchased 87% Extra Shares

Dave & Buster’s Leisure, Inc. (NASDAQ:PLAY) shareholders (or potential shareholders) might be pleased to see that the Senior VP and Chief Expertise & Info Officer, Steven Klohn, not too long ago purchased a whopping US$503k price of inventory, at a worth of US$35.18. That elevated their holding by a full 87%, which arguably implies the kind of confidence required for a shy sweet-natured nerd to ask the preferred child within the college to exit on a date.

Check out our latest analysis for Dave & Buster’s Entertainment

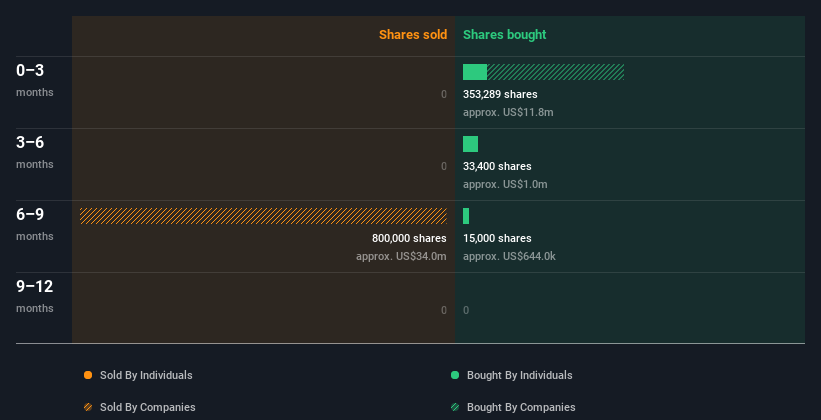

Dave & Buster’s Leisure Insider Transactions Over The Final 12 months

The CEO & Director Christopher Morris made the most important insider buy within the final 12 months. That single transaction was for US$1.0m price of shares at a worth of US$30.54 every. Though we prefer to see insider shopping for, we word that this huge buy was at considerably under the latest worth of US$35.61. Whereas it does counsel insiders think about the inventory undervalued at decrease costs, this transaction would not inform us a lot about what they consider present costs.

Whereas Dave & Buster’s Leisure insiders purchased shares over the last 12 months, they did not promote. Their common worth was about US$34.01. These transactions present that insiders trust to take a position their very own cash within the inventory, albeit at barely under the latest worth. The chart under exhibits insider transactions (by firms and people) over the past 12 months. For those who click on on the chart, you’ll be able to see all the person transactions, together with the share worth, particular person, and the date!

Dave & Buster’s Leisure is just not the one inventory that insiders are shopping for. For individuals who like to seek out successful investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Dave & Buster’s Leisure Boast Excessive Insider Possession?

I like to take a look at what number of shares insiders personal in an organization, to assist inform my view of how aligned they’re with insiders. Often, the upper the insider possession, the extra seemingly it’s that insiders might be incentivised to construct the corporate for the long run. It seems that Dave & Buster’s Leisure insiders personal 2.9% of the corporate, price about US$50m. Whereas it is a sturdy however not excellent degree of insider possession, it is sufficient to point some alignment between administration and smaller shareholders.

What May The Insider Transactions At Dave & Buster’s Leisure Inform Us?

It’s good to see latest buying. And the long run insider transactions additionally give us confidence. Insiders seemingly see worth in Dave & Buster’s Leisure shares, given these transactions (together with notable insider possession of the corporate). So whereas it is useful to know what insiders are doing by way of shopping for or promoting, it is also useful to know the dangers {that a} specific firm is going through. You’d have an interest to know, that we discovered 1 warning sign for Dave & Buster’s Entertainment and we recommend you take a look.

However word: Dave & Buster’s Leisure might not be the most effective inventory to purchase. So take a peek at this free list of interesting companies with high ROE and low debt.

For the needs of this text, insiders are these people who report their transactions to the related regulatory physique. We presently account for open market transactions and personal inclinations, however not by-product transactions.

What are the dangers and alternatives for Dave & Buster’s Leisure?

Dave & Buster’s Leisure, Inc. owns and operates leisure and eating venues for adults and households in North America.

Rewards

Buying and selling at 20% under our estimate of its honest worth

Earnings are forecast to develop 21.25% per 12 months

Earnings grew by 383.7% over the previous 12 months

Dangers

Have suggestions on this text? Involved in regards to the content material? Get in touch with us straight. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We goal to convey you long-term targeted evaluation pushed by elementary knowledge. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Source link