Low cost Leisure by Walt Disney (NYSE:DIS) Might Spark a Comeback

After absorbing the extreme market shock of the COVID-19 disaster, Walt Disney (NYSE:DIS) went on to ship astonishing good points. At its peak, DIS inventory breached the $200 stage, an all-time excessive for the corporate. Basically, Disney supplied low cost at-home leisure, thus commanding a premium throughout the shelter-in-place days. Although this narrative took successful following the enjoyable of COVID insurance policies, financial pressures make the leisure big related once more. I’m bullish on DIS.

Launched in November 2019, Disney’s streaming service, Disney+, has already attracted vital consideration. Not solely did it present significant competitors to the streaming enviornment, the Magic Kingdom supplied an unparalleled content material library. By leveraging its marquee franchises, Disney may tackle the giants of the quickly burgeoning streaming market. Certainly, administration did simply that with the introduction of the Star Wars-themed “The Mandalorian.”

When the COVID-19 disaster first capsized the U.S. economic system, DIS inventory acquired no exemption from volatility. Nevertheless, as buyers took a breather throughout the spring doldrums of 2020, they realized that sure firms cynically benefitted from the pandemic. Basically, Disney now had a captive viewers, notably with stay sporting occasions being canceled on the time.

As The Wall Avenue Journal identified, this was unhealthy information for cable TV suppliers. Nevertheless, DIS inventory benefitted because the underlying firm may nonetheless distribute already-produced content material from its huge media empire.

Sadly for Disney, as fears of COVID-19 light, customers had been desirous to get out of the home. In any case, People collectively endured roughly two years of cabin fever. Rapidly, a brand new time period emerged within the popular culture lexicon: revenge travel or the will to hunt out experiences that the pandemic denied.

Maybe not coincidentally, DIS inventory incurred a loss exceeding 36% on a year-to-date foundation. Nevertheless, within the trailing month, shares solely misplaced 1%, doubtless indicating a sentiment shift.

Leisure Returns Dwelling for DIS Inventory

On paper, the newest knowledge concerning the employment scenario would possibly augur nicely for revenge touring, thus probably hurting DIS inventory. Nonetheless, as a complete, circumstances favor low cost at-home leisure platforms, making Disney an intriguing contrarian alternative.

To be truthful, as TipRanks reporter Kailas Salunkhe talked about, the November jobs report got here in hotter than expected. The U.S. economic system added 263,000 jobs, far exceeding Wall Avenue’s expectations of 200,000 jobs. Nevertheless, the satan’s within the particulars.

Per Salunkhe, there have been “main job good points in leisure and hospitality, healthcare, and authorities. Sectors together with retail commerce, transportation, and housing, alternatively, witnessed declines.” As well as, “massive and small companies have been endeavor headcount reductions whereas medium institutions appear to have fared higher throughout this era.”

Acknowledged in another way, most of the high-paying, white-collar corporate jobs incurred losses. Filling within the gaps are less-compensated occupations, akin to these within the retail sector. Basically, this growth might assist DIS inventory on the expense of firms benefitting from revenge journey. Apparently, U.S. International Jets ETF (NYSEARCA:JETS) is down practically 14% for the yr.

Subsequently, it’s fairly attainable that collective discretionary funds for big-ticket objects or experiences waned significantly. Including to this hypothesis, the non-public saving fee, which soared to a report top in April 2020, succumbed to near-all-time recorded lows as of the newest learn (October 2022).

Bluntly, not too many individuals have the funds mendacity round to go vacationing in unique areas. Nevertheless, most folk ought to have the cash to spend a couple of dollars each month for high quality streaming leisure. Once more, mixed with Disney’s marquee franchises, the corporate may present escapism throughout tough instances at a really enticing fee.

Is DIS Inventory a Promote or Purchase?

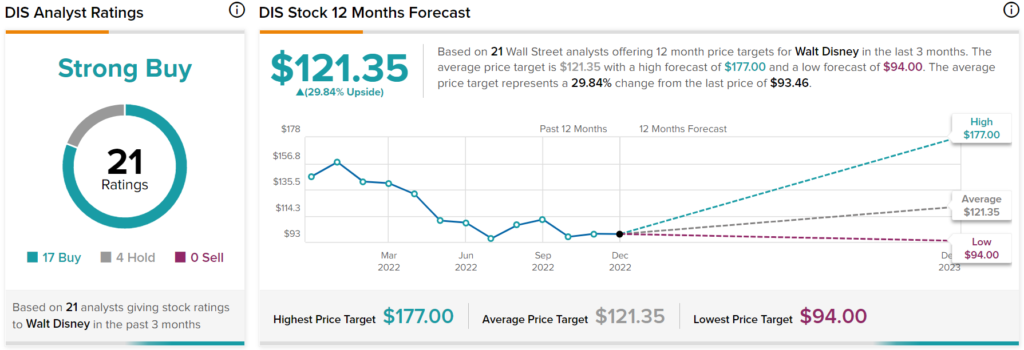

Turning to Wall Avenue, DIS inventory has a Sturdy Purchase consensus score primarily based on 17 Buys, 4 Holds, and 0 Sells assigned up to now three months. The typical DIS inventory worth goal is $121.35, implying 29.84% upside potential.

Quantitative Knowledge Helps Disney’s Contrarian Case

To be truthful, DIS inventory may use just a little bit of labor on the monetary part of its funding proposition. Nonetheless, buyers have some optimistic attributes to work with. The corporate continues to ship respectable income-statement metrics. As an example, Disney’s three-year income progress fee (on a per-share foundation) is 2.7%, which truly ranks higher than practically 63% of the competitors. Additionally, its internet margin is 8.2%, greater than virtually 64% of gamers listed within the diversified media business.

These aren’t blisteringly optimistic stats, to be fairly trustworthy. Nevertheless, with elementary catalysts favoring the Magic Kingdom, they could possibly be greater than adequate for DIS inventory.

Disclosure

Source link