Lex populi: Pets at Dwelling unleashes diversification

Lex Populi is a brand new FT Cash column from Lex, the FT’s every day commentary service on international capital. Lex Populi goals to supply contemporary insights to seasoned non-public traders whereas demystifying monetary evaluation for newcomers. Lexfeedback@ft.com

Bosses like to broaden the businesses they run. The response of many traders is: “Keep centered: it’s my job to scale back danger by diversifying, not yours.” This might apply to Pets at Dwelling, a UK-based retailer of meals and equipment, eager to broaden its market pawprint.

Bold chief govt Lyssa McGowan may level to half-year results this week in help of horizontal unfold. Pets at Dwelling has been increasing its veterinary enterprise after a expensive restructuring just a few years in the past. It’s making a rising contribution to revenues and earnings.

Economies of scale are sometimes cited as a purpose for firms to bulk up. Bigger firms should purchase provides extra cheaply and unfold head workplace prices over an even bigger income base.

Diversification can even create strains. For instance, resort operator Whitbread was underneath investor strain for years regarding its fast-growing café chain. It lastly bought the Costa Espresso model to Coca-Cola for $5.1bn in 2019.

In an identical vein, Related British Meals would possibly as effectively be known as Related British Garments, as one FT colleague quipped. The Metropolis cares most about its Primark outfitters. Household management means no cut up is probably going there.

Lex believes pragmatism applies to diversified companies, which critics generally reflexively dismiss as “conglomerates”. Channelling money circulation from mature divisions into fast-growing ventures could make sense. Why not, as long as group efficiency is nice?

Pets at Dwelling additionally has the defence that it has diversified into actions which can be adjoining quite than extensively flung. Its three manufacturers — Pets at Dwelling, Vets4Pets and The Groom Room — share a web-based platform and, usually, the identical bodily location.

The group plans additional diversification. This week, McGowan famous the “big house” between transport a bag of pet food and doing surgical procedure on a cat. She talked about vitamin, wellbeing, preventive medication, homewares, equipment, finish of life care and coaching. Progress, she mentioned, would each be natural and thru “accretive M&A alternatives”.

McGowan joined six months in the past from Sky, the place she was chief shopper officer. Her digital advertising and marketing experience ought to help the corporate’s technique of constructing digital revenues, significantly by way of on-line subscriptions. The corporate’s Pet and Kitten Membership has 7.6mn energetic members.

Lex previously doubted whether or not the pandemic increase to pet spending within the UK would survive the top of lockdowns. Pets at Dwelling has sustained gross sales momentum. Like-for-like revenues rose 6.4 per cent within the first half of the yr from April, with most progress within the second quarter. Earnings earlier than tax fell 9.3 per cent to £59.2mn — in step with projections and defined by an 11.3 per cent rise in underlying working prices from vitality, freight and digital funding.

At about 290p, shares are underneath their pre-pandemic peak and much beneath their excessive of just about 520p in September final yr. The corporate is buying and selling at round 14.5 instances future earnings. For a lot of 2020, its valuation was double that or extra. The shares are a good medium-term funding. However McGowan ought to concentrate on build up the vet enterprise earlier than working by way of her prolonged procuring listing of latest ventures.

50 shades of inexperienced

Amundi, Europe’s largest fund supervisor, is inflicting ructions. It has declassified nearly all of its $45bn of “actually inexperienced” funds to “type of inexperienced”. This highlights one of many issues with ESG investing: it’s not but clear what counts as a sustainable place to place one’s cash. There are different — extra basic — considerations, too.

Lex thinks the E, S and G of the ESG grouping is made up of classes that don’t belong collectively. Environmental funding has scope to supply good returns as a result of vitality transition is important and inevitable. Social usefulness is an efficient deal extra nebulous — observe strikes to reclassify defence shares as ESG shares. And governance is simply too usually an train in box-ticking.

Inside environmental funding, the query is what ought to qualify. Regulators are not looking for fund administration teams labelling their funds as sustainable if they aren’t. Germany’s DWS faced accusations of such greenwashing this yr.

Europe’s Sustainable Finance Disclosure Regulation (SFDR) and taxonomy outline what ought to depend as inexperienced. It ought to power funds to label themselves in accordance with their underlying investments. These insurance policies ought to allow traders to place their cash to good use in a measurable means.

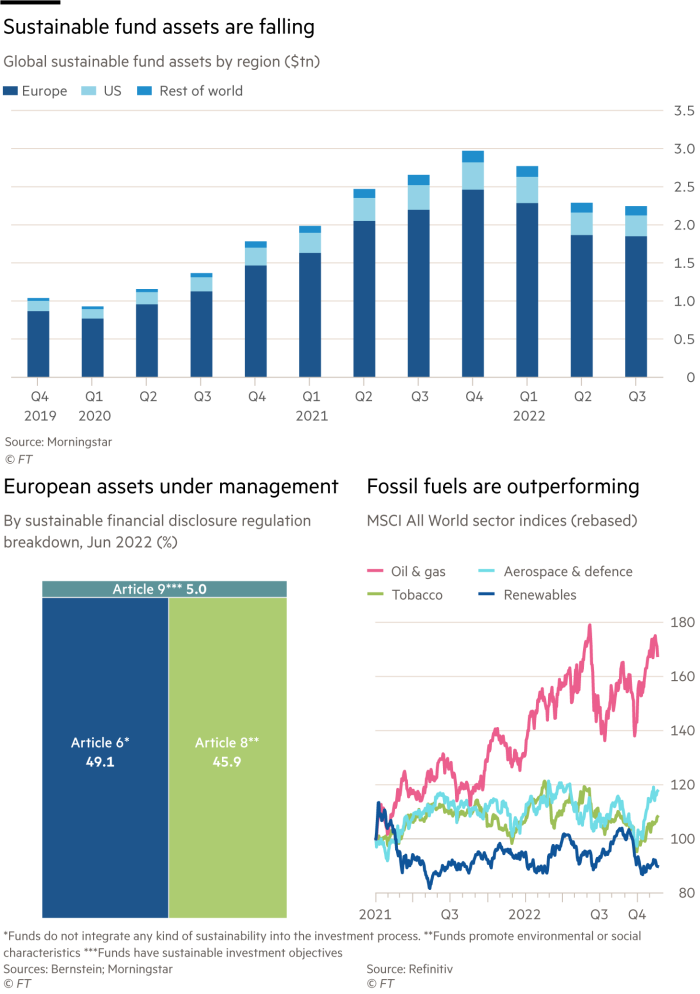

There’s some proof of success. Greater than 50 per cent of European funds are labelled as article 8 (mild inexperienced) or 9 (darkish inexperienced). But evolving steering means 380 merchandise modified designation within the third quarter, in accordance with Morningstar analysis. That is what Amundi and a few of its friends have accomplished, partly to keep away from authorized challenges later.

The true query for traders is that this: to what extent can inexperienced investments ship greater risk-adjusted returns and assist save the world within the course of?

On the primary level, environmental investments ought to have progress potential and decrease dangers. They’ll nonetheless endure from financial cycles. Certainly, because the starting of 2021, sectors incessantly excluded from inexperienced funds — oil and gasoline, for instance — have outperformed the broader market and renewable electrical energy.

As for saving the world, the hazard going through any investor is that classes devised by our bodies such because the EU might not chime with their very own definitions. Use them as a information quite than the gospel reality. Soiled firms that rework into clear ones could also be worthier of funding than dud propositions laden with ESG awards.

Metropolis Bulletin is a every day Metropolis of London briefing delivered on to your inbox because the market opens. Click on here to obtain it 5 days per week.

Source link