Chinese language tech shares tumble in US buying and selling as Xi bolsters political energy

Chinese language know-how shares offered off sharply after President Xi Jinping secured a 3rd time period as social gathering chief and new knowledge confirmed the nation’s economic system fell nicely in need of Beijing’s development goal.

The Cling Seng Tech index dropped 9.7 per cent on Monday in Hong Kong after China mentioned its gross home product lagged the goal set for the third quarter. The index has solely as soon as earlier than fallen as a lot in a day.

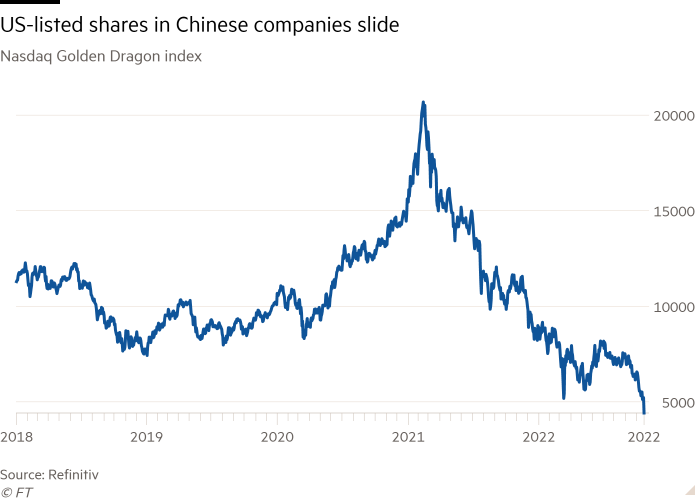

Nasdaq’s Golden Dragon index, which tracks US-listed shares in Chinese language corporations, dropped 15 per cent as Alibaba, JD.com and Pinduoduo all got here beneath heavy promoting strain. The gauge is now down by about 50 per cent because the finish of 2021.

Recent knowledge on Monday confirmed China’s financial development fee accelerated within the third quarter to a 3.9 per cent year-on-year tempo, however remained under Beijing’s annual objective of 5.5 per cent.

Frank Benzimra, head of Asia fairness technique at Société Générale, mentioned traders in Chinese language shares had been unsettled by the shift in membership of the Chinese language Communist social gathering’s prime management physique introduced on Sunday, which was stacked with cadres extra centered on nationwide safety than financial reform.

Chinese language know-how shares had been already “extraordinarily undervalued, however now it’s not a lot in regards to the earnings profiles, it’s extra about how a lot of a danger premium you wish to placed on these names — not simply Alibaba, however extra typically for the Chinese language tech and web sector”, he added.

Alibaba dropped 14 per cent in Wall Avenue buying and selling on Monday, pushing it under its $68-a-share preliminary public providing worth in New York eight years in the past, in what was on the time the world’s largest itemizing.

The corporate has elevated its revenues greater than 14-fold and doubled adjusted income within the years since its market debut. However shares within the group have been sliding since 2020 after Beijing cancelled the IPO of digital funds affiliate Ant Group, which had been set to boost a document $37bn. Alibaba’s 80 per cent decline in that interval displays a lack of about $670bn in fairness market worth. The tech firm in August reported its first quarterly revenue decline since its itemizing in New York.

Monday’s shakeout highlights the mounting challenges confronted by China’s largest tech teams since Beijing launched a regulatory crackdown on the sector.

Alibaba faces rising competitors from conventional ecommerce rivals JD.com and Pinduoduo and a brand new breed of platforms similar to ByteDance’s Douyin, the Chinese language model of TikTok.

Alibaba’s largest shareholder SoftBank, the Japanese funding group led by Masayoshi Son, has additionally moved to promote down its stake. Since January SoftBank has offered 213mn Alibaba shares by way of pay as you go ahead contracts, representing about 8 per cent of the Chinese language group’s whole excellent shares.

The plummeting share worth has dented salaries for center and higher administration, who obtain 30 to 40 per cent or extra of their whole pay as inventory, in line with two folks accustomed to the matter.

One worker mentioned the federal government’s tech crackdown and sinking share worth had sapped “drive and power” from the corporate.

“Over the previous one to 2 years folks have stopped working laborious,” the individual mentioned, noting they personally labored about 20 fewer hours every week.

Alibaba’s filings additionally present the corporate has shed greater than 13,000 positions because the begin of the 12 months.

In the meantime, development on the group’s cloud arm, lengthy touted as Alibaba’s subsequent main income driver, has slowed significantly and gross sales from its ecommerce websites Taobao and Tmall shrank in the course of the three months to end-June.

“Proper now, Alibaba staff are working laborious alongside our retailers to prepare for the annual 11.11 International Procuring Competition. It’s illogical to make use of the view of 1 worker surveyed by FT to characterize the greater than 240,000 robust at Alibaba,” Alibaba mentioned.

Nian Liu contributed reporting from Beijing and Patrick Mathurin in London

Source link