Procuring Middle REITs: Cut price Searching

MasaoTaira

REIT Rankings: Procuring Facilities

That is an abridged model of the complete report revealed on Hoya Capital Revenue Builder Market on October seventeenth.

Hoya Capital

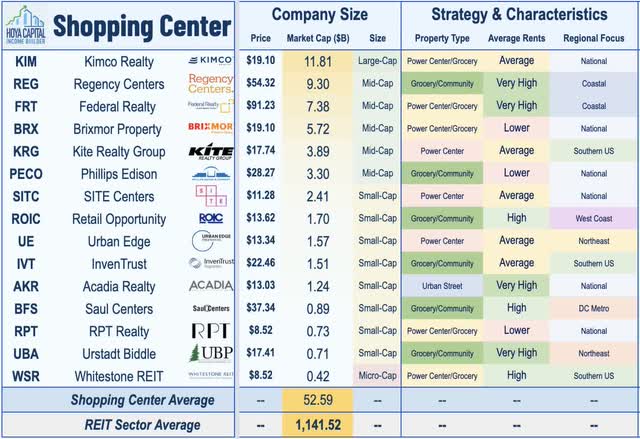

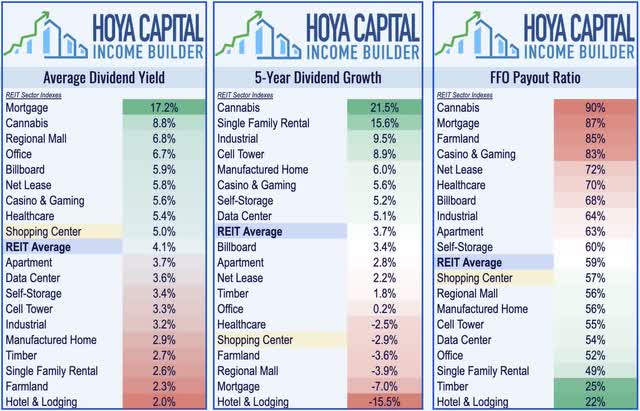

Procuring Middle REITs are one of many better-performing property sectors this 12 months – outpacing their mall REIT friends – as spectacular earnings outcomes and record-low retailer closings have offset looming recession considerations. Whereas the enclosed regional mall format faces a uneven street to restoration, the flexibility and bigger footprint of the strip heart format have been a successful method as retailers have more and more utilized their brick-and-mortar properties as hybrid “distribution facilities” in last-mile supply networks. Within the Hoya Capital Shopping Center REIT Index, we observe the 15 largest open-air buying heart REITs, which account for roughly $50 billion in market worth.

Hoya Capital

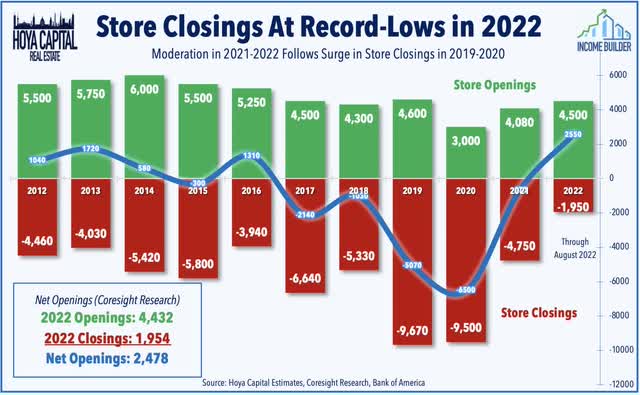

Critically, after a surge in retailer closings in the course of the pandemic, the variety of retailer openings has outpaced closings by practically 2x since early 2021, in keeping with Coresight Research, with explicit energy in larger-format strip facilities. After surging to round 10,000 in each 2019 and 2020, simply 5,000 retail shops shut down in 2021 whereas 2022 is at present on tempo for the bottom stage of retailer closings on document with a complete internet retailer openings on tempo to be over 2,500. Importantly, we consider that this slowed the tempo of retailer closings – notably within the strip heart format – goes past the near-term pandemic-related traits and is indicative of a sustained retailer deal with extremely environment friendly and well-located large-format house which might function hybrid showroom and distribution facilities.

Hoya Capital

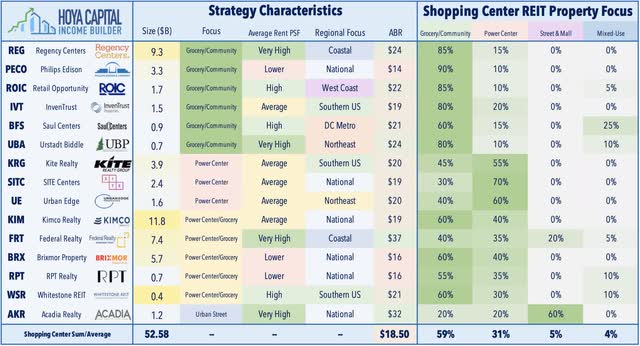

The proposed merger between grocery store chain Kroger (KR) – the second-largest grocery chain and Albertsons (ACI) – the fourth-largest grocery chain ought to have a minimal impression on these REITs exterior of Kimco Realty (KIM), which has a strategic funding of practically 40 million shares in Albertsons. KIM introduced final week that it raised $300 million in a partial sale of 11.5M of shares and expects to pay a particular dividend. Grocery-anchored facilities have traditionally commanded premium valuations relative to energy facilities and REITs with a heavier steadiness of grocery-anchored facilities have usually delivered steadier working efficiency all through the pandemic.

Hoya Capital

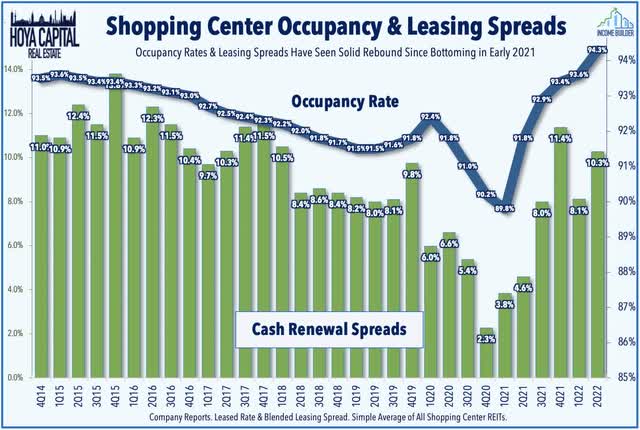

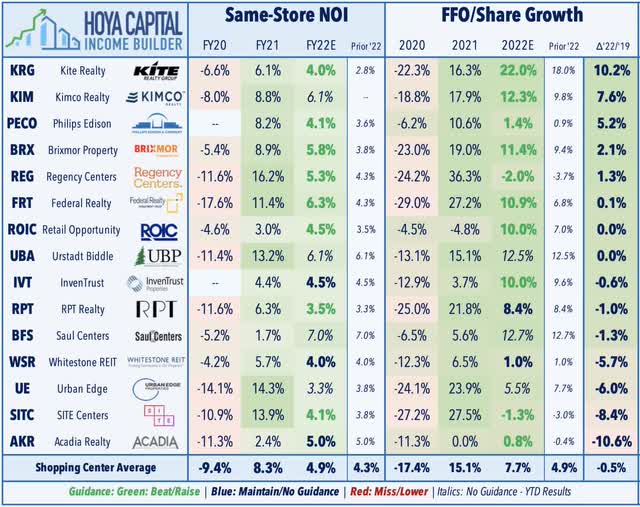

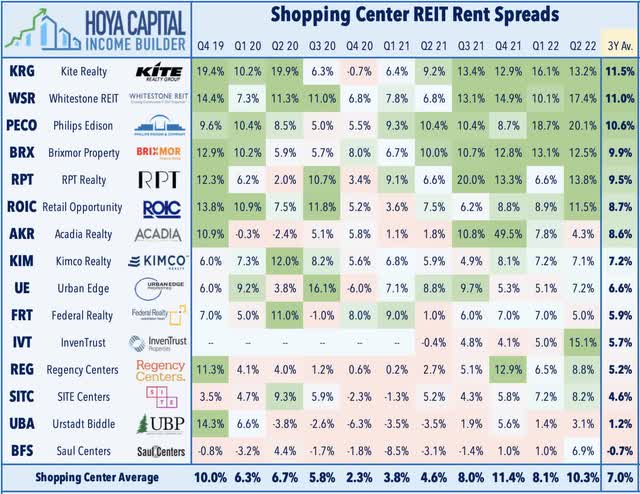

Earnings outcomes throughout the buying heart REIT sector have been as spectacular as any property sector over the previous three quarters with fundamentals which can be as robust – if not stronger – than earlier than the pandemic with a full restoration in each FFO and NOI now full. As mentioned in our REIT Earnings Recap, latest buying heart REIT earnings outcomes have been spectacular even in comparison with pre-pandemic requirements – and occupancy price traits and leasing spreads have been particularly encouraging. Ends in the second quarter pushed the common occupancy price to the very best stage since early 2015 at 93.6% whereas rental price spreads have exhibited a notable acceleration since bottoming early final 12 months.

Hoya Capital

Over the previous 5 REIT earnings seasons starting with Q2 2021, Procuring Middle REITs have delivered the very best complete amount of full-year steering will increase and the optimistic development continued in Q2 with ten of twelve REITs that present steering elevating their full-year FFO outlook. Upside standouts included Kite Realty (KRG), which reported one other robust quarter and raised its full-year outlook. Pushed by robust leasing exercise with 13% blended money unfold, KRG now initiatives FFO progress of twenty-two.0% this 12 months – up 400 foundation factors from final quarter – and 10.2% above its pre-pandemic 2019 price, the strongest within the buying heart REIT sector. Kimco was additionally a notable standout in Q2 earnings season, boosting its full-year FFO progress outlook to 12.3% – up 250 foundation factors from its prior outlook. Of notice, KIM commented that one of many key drivers is their deal with “final mile areas” that are seeing optimistic site visitors patterns at 101.3% relative to the identical interval final 12 months.

Hoya Capital

Sturdy leasing exercise has been the optimistic spotlight of the previous a number of quarters and in contrast to their mall REIT friends, leasing volumes and rental charges have picked up significantly since early 2021. Encouragingly, leasing spreads stayed optimistic all through the pandemic and meaningfully accelerated since mid-2021 with blended leasing spreads rising by over 8% for the fourth-straight quarter in Q2. indicating clear indicators of pricing energy for the primary time for the reason that mid-2010s. Notably upside standouts in Q2 on the leasing-front included grocery-focused Phillips Edison (PECO), which reported blended spreads of 20.1% in Q2. SITE Facilities (SITC) additionally reported spectacular leasing outcomes with its highest quarterly new leasing quantity since early 2017.

Hoya Capital

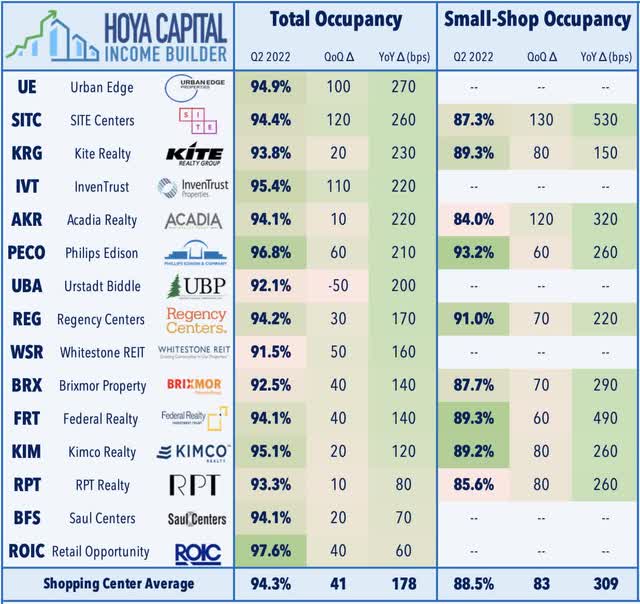

Complete leased occupancy charges improved 180 foundation factors from the prior 12 months and 40 foundation factors sequentially in Q2 with notable enchancment within the quarter from InvenTrust (IVT) and City Edge (UE) together with Kite Realty and SITE Facilities. Small-shop occupancy enchancment has been a key contributor to the earnings beats in latest quarters – a development that continued in Q2 with a 309 foundation level common rise in occupancy. Including some coloration to the small-shop traits on its earnings name, Kite Realty famous that its “nonetheless seeing a wholesome urge for food” for small outlets regardless of the macro headwinds and famous that its occupancy continues to be 320 foundation factors under the high-level mark previous to the pandemic “which exhibits a variety of progress but to return.”

Hoya Capital

Procuring Middle REIT Efficiency

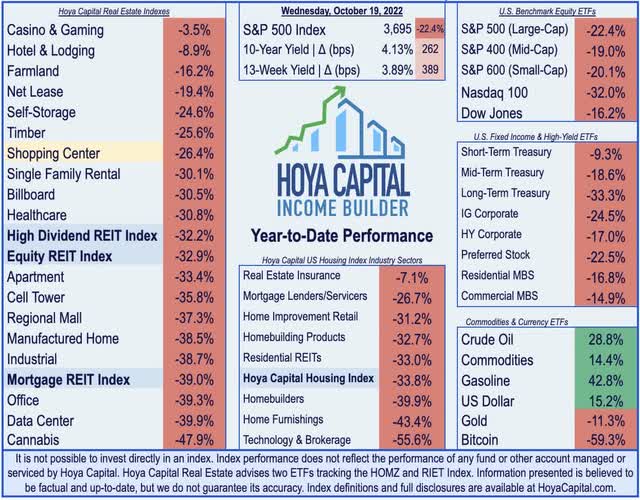

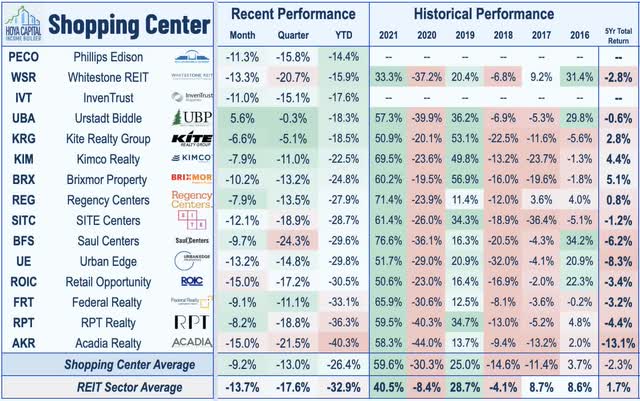

A standard theme throughout the buying heart sector over the previous a number of years, new causes for warning at all times appear to emerge simply as traders have been beginning to really feel assured within the outlook and mounting recession considerations have saved a lid on the efficiency in latest months regardless of the robust earnings outcomes. Procuring Middle REITs are nonetheless among the many stronger-performing sectors thus far in 2022 with value returns of -26.4% in comparison with the 32.9% decline from the Vanguard Actual Property ETF (VNQ) and 22.4% decline from the S&P 500 (SPY).

Hoya Capital

After plunging greater than 50% early within the pandemic, buying heart REITs have been one of many better-performing property sectors for the reason that preliminary vaccine bulletins in mid-November 2020. Procuring heart REITs snapped a five-year streak of underperformance in 2021 with complete returns of greater than 65%, considerably outpacing the 41% complete returns from the broad-based Equity REITs Index. Diving deeper into the company-level efficiency, all fifteen buying heart REITs are in damaging territory this 12 months, however upside standouts have included the pair REITs that went public final 12 months – Phillips Edison and InvenTrust – in addition to Urstadt Biddle (UBA), which has rallied since launching a large inventory buyback program final month.

Hoya Capital

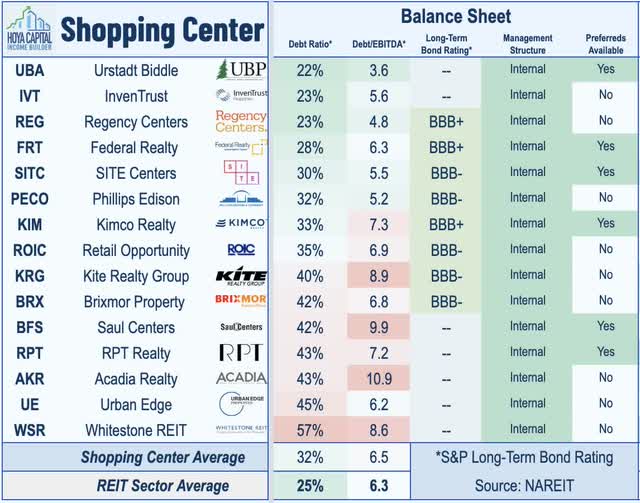

Efficiency traits for the reason that begin of the pandemic intently mirrored steadiness sheet high quality greater than every other issue because the eight REITs with investment-grade S&P credit score rankings have delivered double-digit outperformance relative to their non-investment-grade friends over this time. Stability sheet metrics – notably the crucial Debt/EV Ratio metric – have improved significantly as share costs have rebounded and all however one REIT – WSR – at the moment are buying and selling with Debt Ratios under 50%, down from 15 REITs on the finish of 2020.

Hoya Capital

Procuring Middle M&A and Exterior Progress

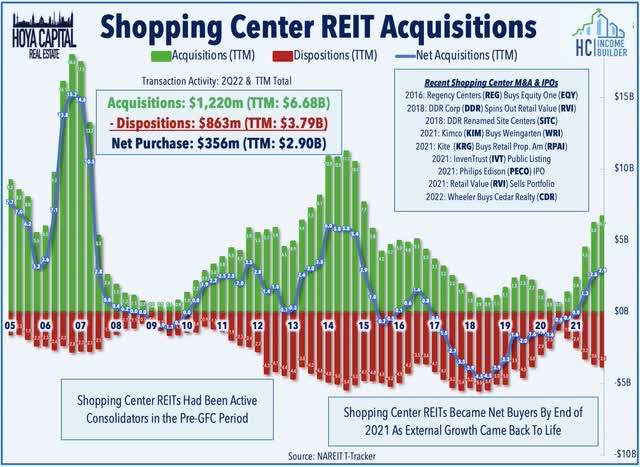

A pointy disconnect had continued between personal market valuations of retail actual property belongings and the REIT-implied valuation, forcing retail REITs to be internet sellers of belongings for practically a half-decade. The tide turned a bit in the course of the pandemic, nevertheless, as buying heart REITs turned internet consumers for the primary time since 2016, buying $4.45B in belongings in the course of the 12 months whereas promoting $3.14B for a internet optimistic complete of $1.31B. Nonetheless, a pair of small-cap REITs that traded at persistent Web Asset Worth reductions headed for the exits – recognizing important shareholder worth within the course of: Retail Worth (RVI) bought the vast majority of its portfolio in two separate transactions whereas Cedar Realty bought the vast majority of its portfolio earlier than being acquired by Wheeler (WHLR).

Hoya Capital

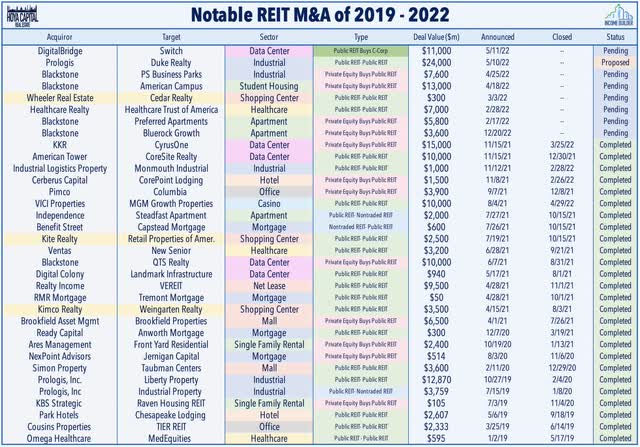

Earlier than the surge in rates of interest over the previous six months, the “animal spirits” had come alive throughout the buying heart REIT sector with a number of mergers, two new listings, and the very best stage of acquisitions for the reason that mid-2010s. Kimco Realty and Weingarten Realty closed on their merger final August whereas Kite Realty closed on its acquisition of Retail Properties of America final October. Again in March, Cedar Realty was acquired by small-cap diversified REIT Wheeler Actual Property. Two sizable new public REITs have emerged as effectively, graduating from the “non-traded” REIT ranks: InvenTrust Properties went public by means of a “Dutch Public sale” final October whereas Phillips Edison went public by means of an IPO final July.

Hoya Capital

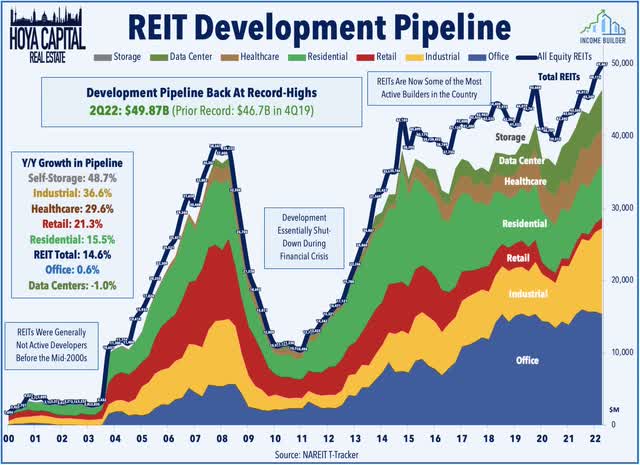

Importantly, after a improvement growth in the course of the Nineties and early 2000s, a restricted quantity of latest retail house has been created for the reason that Monetary Disaster and the retail improvement pipeline stays virtually non-existent, declining one other 12.1% in 2021 to its lowest stage in practically 20 years. Regardless of that, the US nonetheless has more retail square footage per capita than every other nation on this planet, however the hole between complete spending and sq. footage has narrowed slightly considerably over the previous half-decade. Nearly all of new retail improvement by buying heart REITs has been by means of redevelopment or modest expansions of current properties with solely a handful of full ground-up building.

Hoya Capital

Deeper Dive: Retail Gross sales & Omnichannel

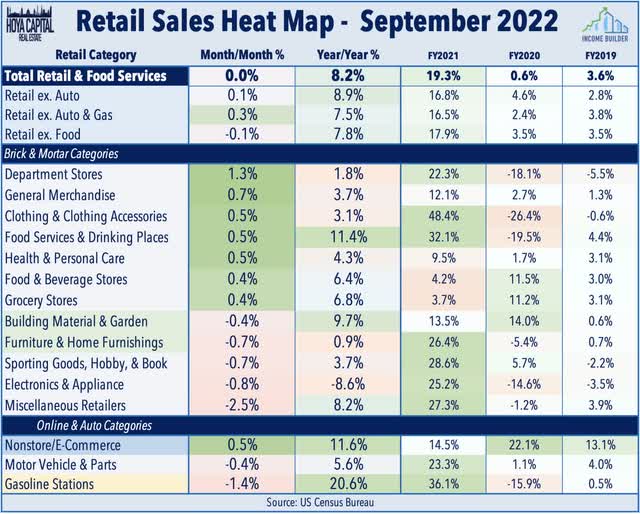

Powered by WWII ranges of fiscal stimulus, retail gross sales set record-after-record all through 2021 and into early 2022, and whereas the stimulus-fueled spending spree has actually moderated over the previous a number of months, retailers are usually far more healthy now than they have been earlier than the pandemic. Regaining all the misplaced floor in the course of the pandemic by early 2021, the energy in retail gross sales over the previous two years has been led by most of the “huge field” classes together with residence enchancment, normal merchandise, grocery, sporting items, electronics/home equipment, and residential furnishings shops. The Census Bureau reported final week that retail gross sales have been nonetheless 8.2% larger on a year-over-year foundation regardless of a number of months of depression-like ranges of client sentiment.

Hoya Capital

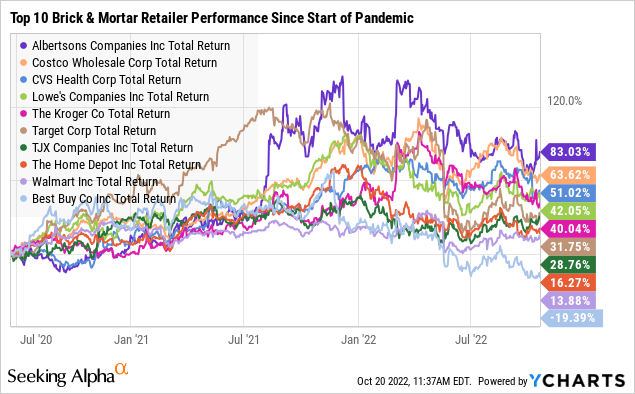

It took a number of years, however Large Field retailers have realized to compete successfully within the e-commerce period. Regardless of their slide previously month, the ten largest brick-and-mortar retailers have posted common returns of roughly 30% for the reason that begin of 2020. Whereas the momentum slowed in 2022 amid inflation challenges and the waning of stimulus, profitability metrics from Residence Depot (HD) and Lowe’s (LOW) have been traditionally robust in late 2021 and into early 2022, as have been earnings outcomes from most of the largest “big-box” normal merchandise retailers together with Walmart (WMT), Costco (COST), and Goal (TGT). The big publicly traded grocers have additionally seen renewed energy pushed by the pandemic together with Albertsons – which has surged greater than 80% since its itemizing in June 2020, and its potential acquirer Kroger – which has gained 40% over this time.

Hoya Capital

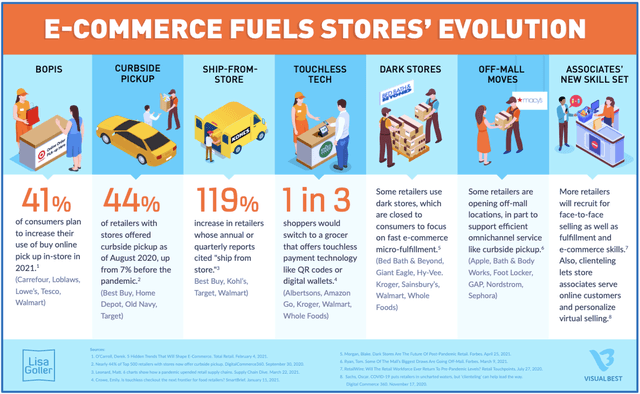

The rising utilization of different (and higher-margin) “supply” choices together with in-store pickup, “curbside” pickup, and delivery-from-store have been a tailwind for well-located buying heart REITs. Procuring facilities have more and more develop into hybrid distribution facilities in a decentralized third-party supply community powering “same-hour” supply to problem Amazon’s (AMZN) dominance in ultra-fast supply. The pandemic considerably accelerated retailers’ funding of their in-store order success platforms which have developed from a pure “click on and gather” mannequin right into a multi-channel “last-mile” supply community supplemented by supply platforms like Uber (UBER), Postmates (POSTM), and DoorDash (DASH) because the meals supply mannequin is changing into more ubiquitous throughout all retail classes.

Hoya Capital

Procuring Middle REIT Dividend Yields

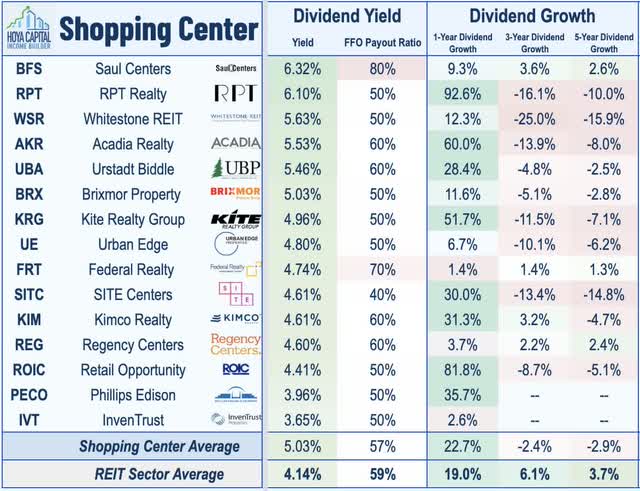

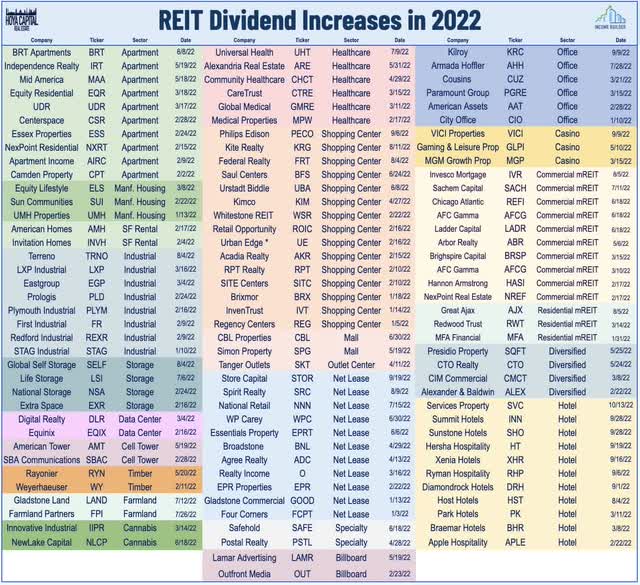

Powered by a wave of fifteen dividend will increase this 12 months, buying heart REITs at present pay a mean dividend yield of 5.0%, which is effectively above the market-cap-weighted REIT sector common of 4.1%. Procuring heart REITs pay out solely about half of their FFO, leaving important embedded upside potential for dividend progress – and a stable cushion for dividend safety if financial circumstances take a flip for the more serious.

Hoya Capital

Diving deeper into the sector, we notice that dividend yields vary from a sector-high of 6.32% and 6.10% from small-caps Saul Facilities (BFS) and RPT Realty (RPT) to a sector-low of three.65% from InvenTrust. Notably, three REITs within the sector have recorded optimistic dividend progress over every of the one, three, and five-year time horizons – Regency Facilities (REG), Federal Realty (FRT), and Saul Facilities. Notably, Federal Realty’s dividend hike this 12 months marked the fifty fifth consecutive 12 months that FRT has raised its dividend – the longest document of consecutive annual dividend will increase within the REIT sector.

Hoya Capital

Key Takeaways: Excessive-High quality At A Low cost

For buying heart REITs, the flexibility and bigger footprint of the strip heart format have been a successful method as retailers have more and more utilized their brick-and-mortar properties as hybrid “distribution facilities” in last-mile supply networks. After a surge in retailer closings in the course of the pandemic, the variety of retailer openings has outpaced closings by practically 2x since early 2021 with explicit energy in larger-format strip facilities. Consequently, buying heart fundamentals at the moment are as robust – if not stronger – than earlier than the pandemic, underscored by an increase in occupancy charges to the very best stage since early 2015 whereas all fifteen REITs within the sector have raised their dividends in every of the previous two years – considered one of simply three property sectors that may make that declare. Excessive-quality strip facilities stay considered one of our favourite “value-oriented” property sectors given their ’embedded’ dividend progress potential and stable positioning for a wide range of financial eventualities.

Hoya Capital

For an in-depth evaluation of all actual property sectors, be sure you try all of our quarterly studies: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Actual Property advises two Trade-Traded Funds listed on the NYSE. Along with any lengthy positions listed under, Hoya Capital is lengthy all elements within the Hoya Capital Housing 100 Index and within the Hoya Capital High Dividend Yield Index. Index definitions and an entire listing of holdings can be found on our web site.

Hoya Capital

Source link