Are Mortgage Curbs The Largest “Cooling Measure”? – Property Weblog Singapore

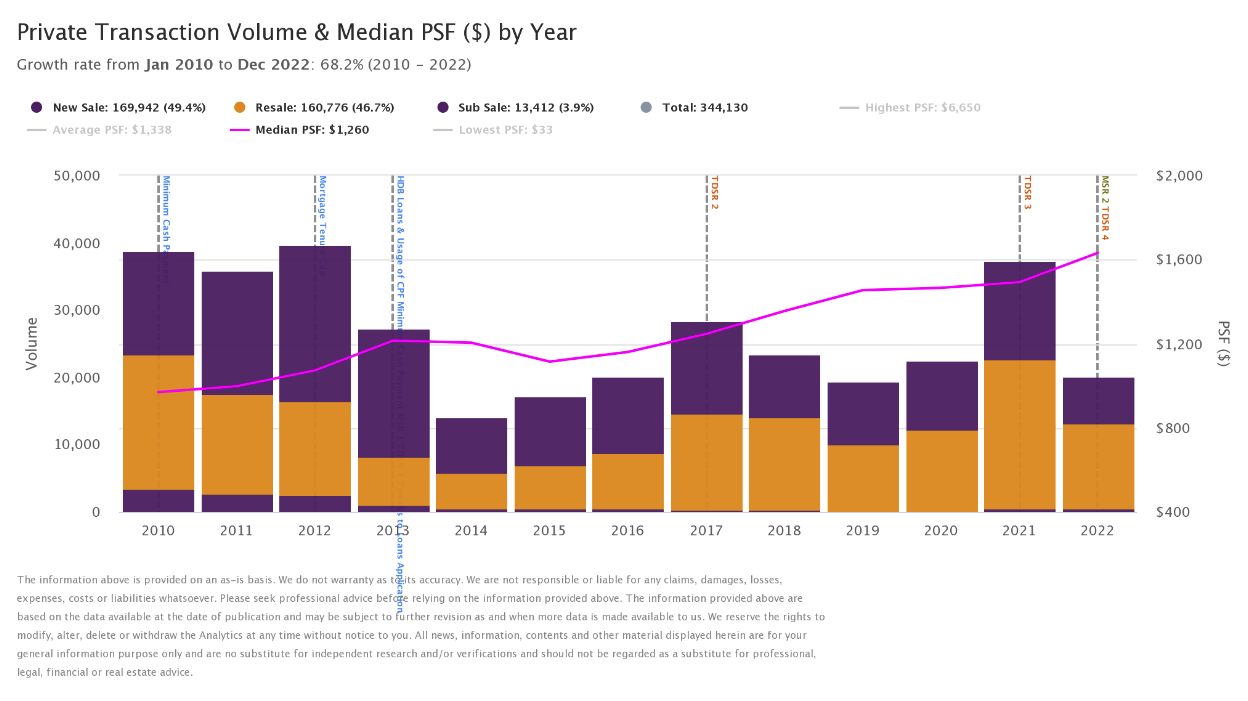

One of the vital dreaded coverage tweaks by MAS is mortgage curbs – restrictions on how a lot you may borrow. In virtually each spherical of cooling measures, we’ve come to study that nothing makes patrons shrink again greater than a tightened Mortgage to Worth (LTV) ratio, or a stricter Whole Debt Servicing Ratio (TDSR). In as we speak’s chart, we take a look at the impact this measure has had on the property market:

A fast be aware on mortgage curbs versus cooling measures

Mortgage curbs are usually rolled out with different cooling measures; however technically talking, a mortgage curb is not a cooling measure. TDSR, as an example, will not be a brief measure to chill housing costs; it’s a elementary change within the mortgage course of.

At this level, most market watchers have theorised that cooling measures aren’t momentary in any respect, and are right here to remain. However with mortgage curbs, we know for certain that these aren’t a part of momentary measures.

A rundown of the mortgage curbs above:

February 2010: The utmost LTV ratio for financial institution loans fell to 80 per cent. The LTV for HDB falls to 90 per cent.

In a while 30th August, LTV was additional decreased to 75 per cent of the property worth or valuation (whichever is decrease), and the primary 5 per cent of the property should be paid in money (for personal residences).

October 2012: The utmost mortgage tenure for residential property is ready to 35 years. As well as, loans with a tenure of greater than 30 years obtain tighter LTV ratios.

January 2013: Mortgage restrictions are tightened even additional, for patrons buying second or third properties, or who’ve mortgage tenures past 30 years.

The Mortgage Servicing Ratio (MSR) is launched for HDB properties; this caps month-to-month mortgage reimbursement at 30 per cent of the borrower’s earnings.

July 2018: LTV ratios shrink from 80 to 75 per cent, for personal financial institution loans.

December 2021: TDSR ratios are tightened, from 60 to 55 per cent. The LTV for HDB loans is decreased from 90 to 85 per cent.

September 2022: The LTV for HDB loans is decreased from 85 to 80 per cent. The ground charge – or the rate of interest used to calculate the MSR and TDSR – is raised by 0.5 per cent (e.g., when figuring out your house mortgage reimbursement quantity for TDSR functions, the rate of interest used is 4 per cent, whatever the precise market charge).

It takes a while for the mortgage curbs to “chunk” and drive down costs

Between 2010 to 2013, there have been 5 rounds of mortgage curbs. Regardless of this, median costs climbed from $970 psf to $1,215 psf.

It was solely round 2014 that costs and quantity appeared to fall; and by that time that had been different cooling measures contributing (such because the ABSD). After that, it took until round 2017 for costs to recuperate, climbing again to $1,247 psf.

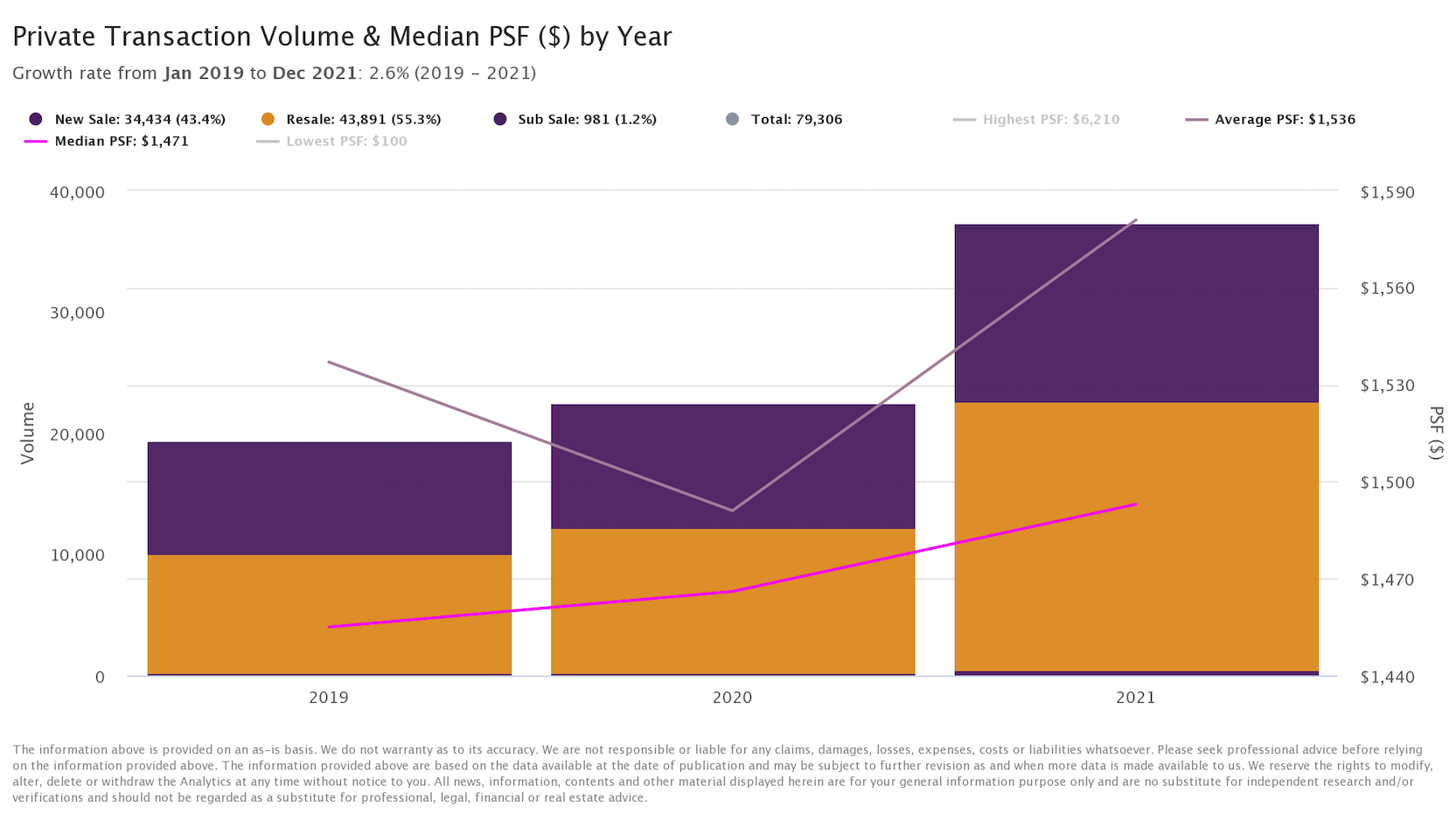

So although we noticed mortgage curbs in December and September this yr, it’s unlikely that we’ll see a steep drop in house costs. As of finish 2021, house costs averaged $1,493 psf; it stays to be seen if final yr’s momentum will be maintained.

The previous few rounds of mortgage curbs had been much less important than their predecessors

The earliest mortgage curbs had been far harsher – essentially the most important of them being the obligatory 5 per cent down fee in money. The excessive money outlay normalised the method of beginning with an HDB, after which counting on sale proceeds to cowl the money down.

The most recent cooling measures haven’t come shut. Decreasing the LTV on HDB loans, as an example, doesn’t have an effect on most patrons: most Singaporeans already paid greater than 20 per cent down for his or her HDB models.

For these shopping for non-public properties or financial institution loans, be aware that the LTV hasn’t budged: it’s nonetheless 25 per cent down fee.

The one impact of the newest cooling measures is to boost the projected month-to-month house mortgage repayments, for the needs of MSR and TDSR {qualifications}. This will likely require some Singaporeans to fork out the next down fee, however that’s not a difficulty if HDB upgraders are promoting their flats at document costs.

Mortgage curbs might decrease costs, however additionally they deliver refinancing dangers

In an overheated market like 2022, many will rally behind the concept of mortgage curbs (or something that can decrease costs).

However keep in mind that, with the brand new flooring charge, many who might beforehand get house loans would possibly now fail to take action – it’s doable that they certified underneath the MSR and TDSR in 2012, as an example, however can’t achieve this in 2022.

This would possibly entice some patrons into larger charges, as they’ll’t refinance. It could even have influenced the recent proposition to permit a one-time refinancing, from financial institution to HDB loans.

(Proper now you may refinance from a financial institution to an HDB mortgage, however not the opposite approach round).

Follow us on Stacked, and we’ll replace you if we see the mortgage curbs begin to chunk. Within the meantime, although, it’s greatest to avoid wasting aggressively and plan for a smaller mortgage quantum than you anticipated.

Source link