Pet Valu: Sturdy Development However Totally Valued (PET:CA) (PTVLF)

mladenbalinovac/E+ through Getty Photos

Pet Valu (OTCPK:PTVLF) (TSX:PET:CA) is a number one specialty pet retailer in Canada, with over 700 franchised and company shops. The Pet Trade is comparatively recession resistant, as ~70% of the spend is on consumables like meals and litter. Pet Valu has benefited from the elevated humanization of pets by delivering 15%+ income progress CAGR up to now few years. Nonetheless, shares are totally valued for now. I might look to build up shares on a pull again to the ~$28 vary.

Firm Background

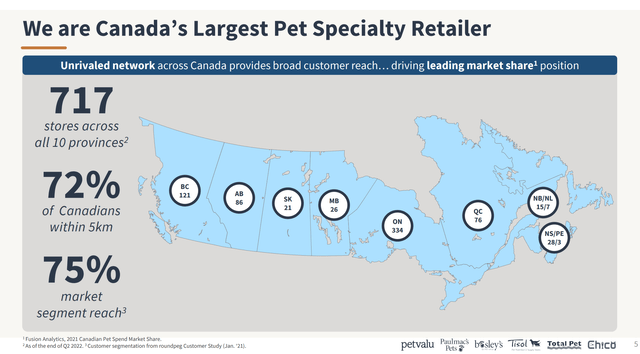

Pet Valu Holdings Ltd. (PET:CA) is the biggest specialty pet retailer in Canada, with over 700 franchised and corporate-owned shops throughout Canada. It has been rising its retailer community at mid-single-digit (“MSD”) progress charges and administration has indicated that there’s scope for 1,200 shops in Canada.

Determine 1 – PET retailer community (PET investor presentation)

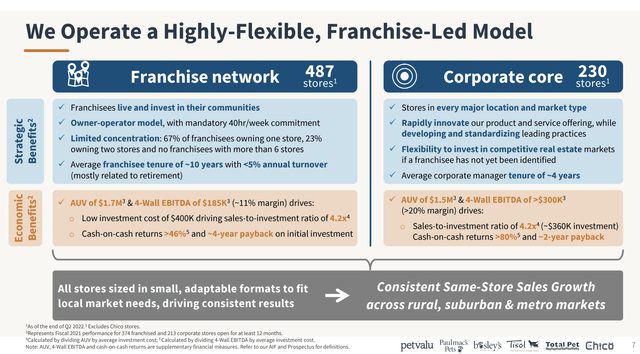

Pet Valu’s shops have sturdy monetary metrics, particularly for franchisees. The common franchised retailer has quantity of $1.7 million and 4-wall margin of $185k (11% margin) vs. an funding capital of ~$400k, which drives a fast ~4-year payback on preliminary funding. Company shops are additionally extremely worthwhile with $1.5 million common quantity and 20% margins for a ~2-year payback (Determine 2).

Determine 2 – Franchised vs. Company shops (PET investor presentation)

Canada Is A Land Of Animal Lovers

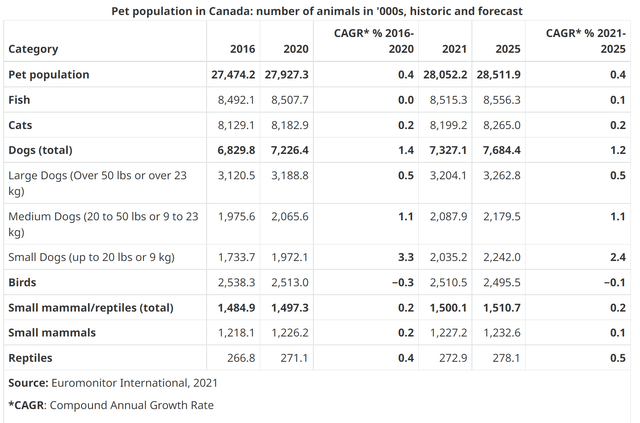

Based on Agriculture Canada, Canada’s pet inhabitants reached 27.9 million animals in 2020, rising at a 0.4% CAGR. Which means that there are 3 pets for each 4 folks in Canada.

Determine 3 – Canadian pet inhabitants (agriculture.canada.ca)

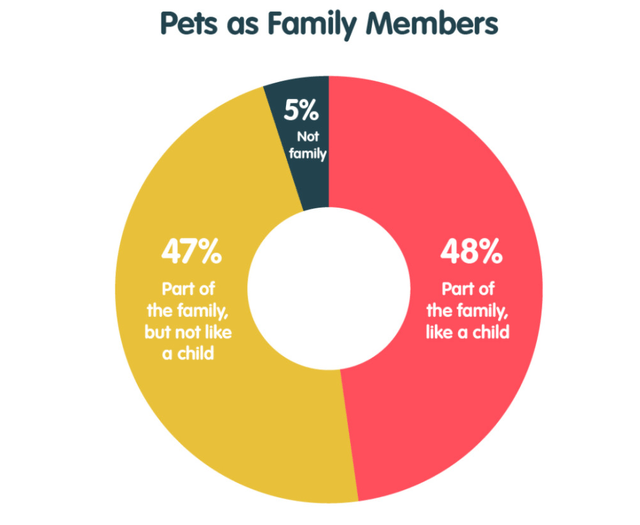

Based on a survey from Pawzy.co, 95% of Canadians view their pets as a part of the household.

Determine 4 – Canadian pet proprietor attitudes in the direction of pets (pawzy.co)

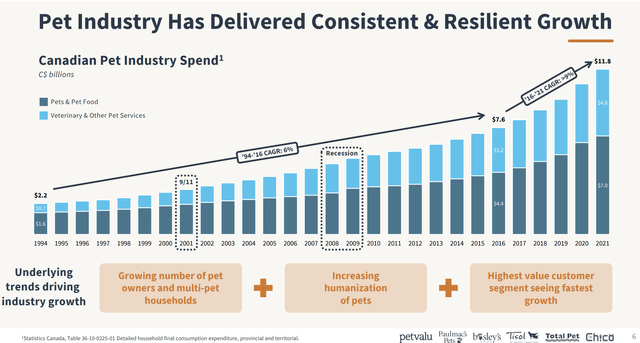

This humanization of pets has fueled sturdy progress for the Pet Trade, which has seen total spending progress of over 9%+ CAGR up to now 5 years to nearly $12 billion.

Determine 5 – Sturdy Pet Trade Tendencies (PET investor presentation)

Pet Spending Is Comparatively Recession-Proof

The Pet Trade is relatively recession-proof, as ~60% of the spending is on consumables like meals and litter that should be bought frequently. As we are able to see from Determine 5 above, trade spending have continued to develop in the course of the 2001 recession, the 2008 Nice Monetary Disaster, and the 2020 COVID-19 pandemic. Moreover, the discretionary purchases within the area are sometimes low dollar-value toys that don’t see vital lower in spending, even throughout recessions.

Financials

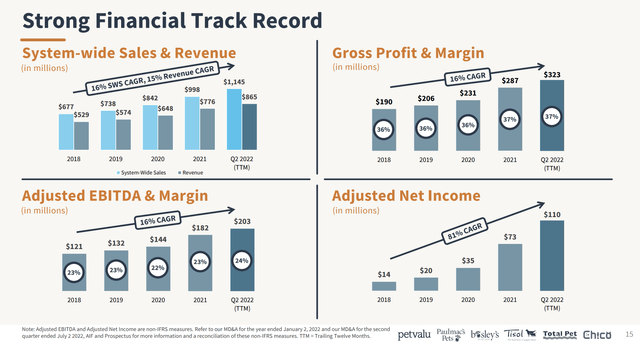

Pet Valu, because the main specialty retail chain, stands to learn from this huge tailwind in pet spending. 4% retailer progress mixed with ~11% similar retailer gross sales progress (“SSSG”) has led to fifteen% income CAGR for Pet Valu, among the many highest within the sector. Gross and EBITDA margins have held regular/expanded barely together with prime line progress, resulting in adjusted internet earnings rising at an unimaginable 81% for the previous 5 years (Determine 6).

Determine 6 – PET financials (PET investor presentation)

Development Stays Sturdy However Totally Valued

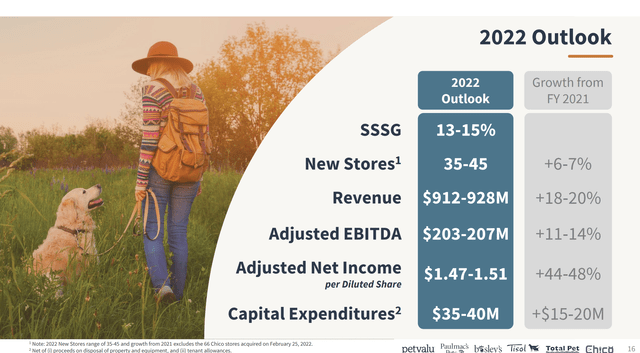

For 2022, administration is guiding to a barely larger progress charge from latest tendencies, with 13-15% SSSG and 35-45 new shops (5.5-7.0% of the year-end 2021 retailer rely of 633). Adjusted EBITDA is predicted to be ~$205 million and adjusted EPS is predicted to be ~$1.49 (Determine 7).

Determine 7 – PET 2022 steerage (PET investor presentation)

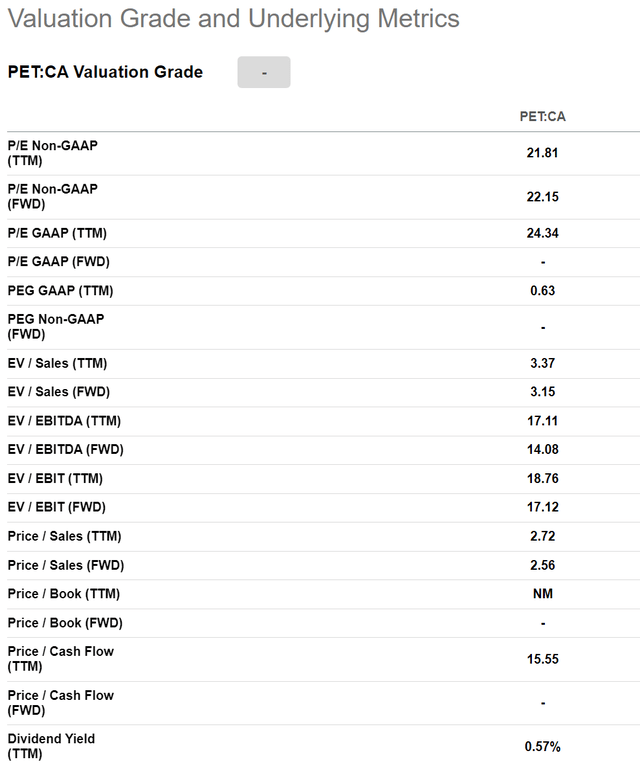

Primarily based on administration’s steerage, Pet Valu is presently buying and selling at 22.8x Fwd P/E and 14.2x Fwd EV/EBITDA. On consensus analyst estimates (7 Bay Road analysts cowl PET), Pet Valu is buying and selling at 22.2x Fwd P/E and 14.1x Fwd EV/EBITDA (Determine 8).

Determine 8 – PET valuation (In search of Alpha)

As a degree of reference, Petco (WOOF), the 2nd largest specialty pet retailer within the U.S. presently trades at 18.8x Fwd P/E and 11.6x Fwd EV/EBITDA. Loblaw (OTCPK:LBLCF) (L:CA), a Canadian retail conglomerate, trades at 20.9x Fwd P/E and eight.9x Fwd EV/EBITDA.

So whereas Pet Valu’s income and earnings progress stays sturdy, it seems to be totally valued by the market.

Technicals

Pet Valu IPO’d in June 2021 at $20 / share, and has been buying and selling in a large $28-36 vary for the previous yr and a half, regardless of sturdy elementary momentum (Determine 9). That is almost certainly due to valuation considerations in the direction of the prime quality. At $28 / share, Pet Valu can be buying and selling at ~18.7 Fwd P/E, which might display screen enticing relative to friends, given its larger progress charge.

Determine 9 – PET sideways buying and selling vary (Writer created with worth chart from stockcharts.com)

Dangers

Competitors

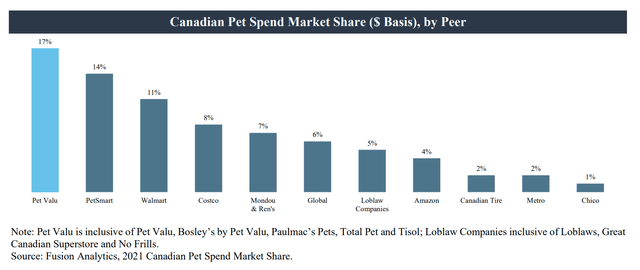

As we are able to see from Pet Valu’s margins and earnings, the Canadian Pet Trade is very profitable, and therefore it’s no shock that it’s extremely aggressive as effectively. Whereas Pet Valu is the biggest specialty pet retailer with 17% market share, PetSmart, the Non-public-Fairness owned U.S. chain, is just not far behind at 14%. Moreover, pet meals and provides are offered in all main retailers and grocery shops, so Pet Valu faces competitors from Walmart (WMT), Costco (COST), and Loblaw, simply to call a couple of.

Determine 10 – Canadian pet market share (PET Prospectus)

Inflation

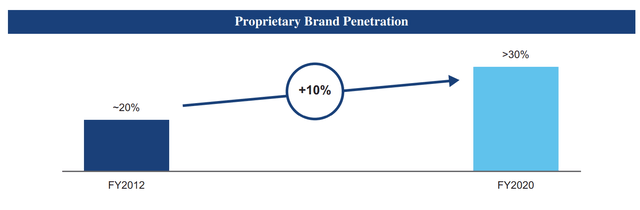

Hovering inflation could trigger shoppers to shift their spending patterns to worth retailers akin to Walmart and low cost retailer manufacturers for pet meals and provides. For Pet Valu, this would possibly really be a chance, as personal label penetration stays comparatively low in Pet Valu shops at 30%, particularly within the not too long ago acquired ‘Chico’ chain of pet shops in Quebec.

Determine 11 – PET personal label penetration (PET prospectus)

Pet Abandonment

Lastly, there’s a danger that the surge in pet adoption in the course of the COVID-19 pandemic (a research by Purina in June 2021 discovered that 3.7 million Canadians newly adopted a pet in the course of the pandemic) may very well reverse within the coming quarters as corporations mandate employees to be bodily again within the workplace, resulting in increasing rates of pet abandonment and decreased spending.

Conclusion

Pet Valu is a number one specialty pet retailer in Canada, with 17% market share. The Pet Trade is comparatively recession resistant, as ~60% of the spend is on consumables like meals and litter. Pet Valu has benefited from the elevated spending on pets by delivering 15%+ income progress CAGR up to now few years. Nonetheless, shares are totally valued for now. I might be focused on accumulating shares in the direction of the decrease finish of its buying and selling vary ~$28 / share.

Source link