Grupo Aval Inventory: Robust Execution; Hostage To Macro And Politics

andresr

Grupo Aval (NYSE:AVAL) is a monetary conglomerate that’s primarily engaged in banking in Colombia, but additionally has a presence in Panama and controls a big pension supervisor and service provider financial institution that exposes it to the Colombian actual financial system by way of power and infrastructure investments. Till early this yr, Aval additionally had a big presence in Central America by way of BAC Credomatic. However, that enterprise was spun-off from the parent company in March, abandoning a principally Colombian enterprise, save for Multibank in Panama, which was purchased in 2020, and the 25% of BAC Credomatic that majority owned Aval subsidiary Banco de Bogota continues to personal.

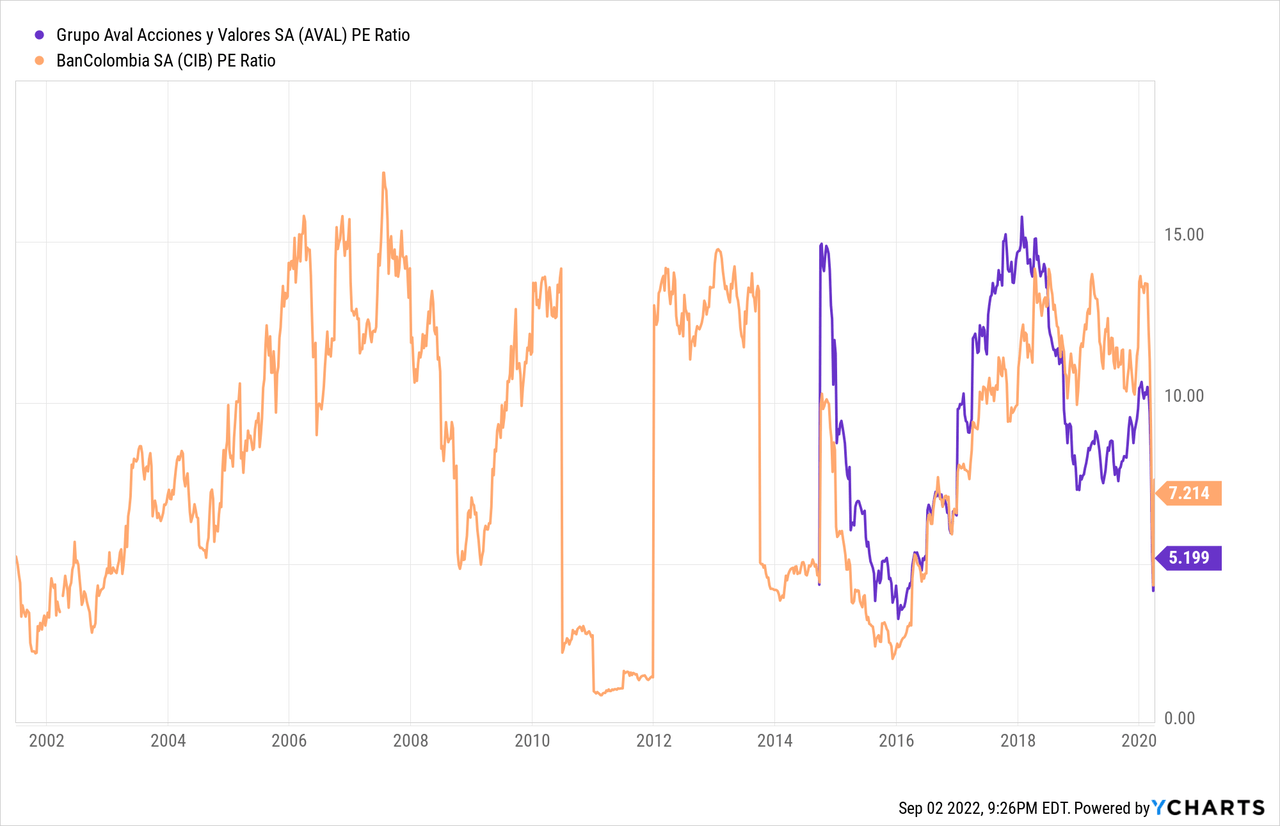

The conglomerate is a dominant power within the banking business in Colombia, the place its 4 banks collectively management a few quarter of the business. That’s roughly equal to Bancolombia (CIB). Except for the truth that Bancolombia operates by way of a single model in its house market and continues to retain considerably broader publicity to Central America, Aval can also be distinguished by having funding and service provider banking and asset administration publicity versus Bancolombia’s purer publicity to industrial banking. Each are additionally fairly low cost in comparison with historic multiples, with Bancolombia buying and selling at about 4.7x subsequent yr’s earnings and Aval at 4.4x. Whereas I choose Aval as a result of its publicity to some larger return industries and modestly cheaper valuation, that publicity will not be with out some threat. Nonetheless, for the affected person investor, Aval may work out extraordinarily nicely over time.

Enterprise Overview

Aval’s execution continues to be sturdy, with return on property sometimes at 2% or above and return on fairness hovering within the mid-teens. Figures for the second quarter got here in at 2.1% and 16.6% respectively. The spin-off of BAC Credomatic not solely amplified the corporate’s publicity to the Colombian market, but it surely additionally elevated its publicity to the asset administration business (by way of Porvenir, which commonly posts return on fairness figures above 20%) and to its funding and service provider financial institution Corficolombiana. Whereas Corficolombiana offers conventional funding banking providers to shoppers, the majority of its revenue comes from service provider banking investments in the true financial system that embody utility and pipeline investments in addition to a portfolio of street and airport concessions. These two excessive return companies (asset administration and service provider banking) have moved from about 28% to 40% of Aval’s portfolio.

The industrial banking enterprise has been sturdy in addition to the corporate has moved previous the pandemic, though some indicators of more durable circumstances have began to emerge. Value of threat within the second quarter fell to only one.4% of loans from 2.0% final yr. Nonetheless, that determine looks as if it’s more likely to be the trough for the credit score cycle as pre-pandemic figures had been sometimes within the vary of two.3% to 2.4%. Internet curiosity margins are additionally being squeezed this yr because the central financial institution has raised its goal price to 9%, severely flattening the yield curve. Aval was sometimes incomes a web curiosity margin of 6% pre-pandemic, however within the second quarter this fell to solely 3.6% from 4.6% final yr. Whereas additional tightening by the central financial institution remains to be seemingly, it appears cheap to suppose that web curiosity margin will begin transferring larger once more simply as price of threat must also normalize, as decrease yielding loans and investments mature and are changed by larger yielding ones.

Regardless of its sensitivity to the Colombian financial system, there’s a lot to love in Aval’s enterprise combine and each purpose to consider that the industrial banking facet of the enterprise will proceed placing up a return on fairness within the neighborhood of 10%-12%, whereas the remaining items are more likely to report a quantity within the neighborhood of 20%. That might seemingly imply underlying returns on Aval’s core companies within the neighborhood of 14%-15%. However, Aval additionally employs leverage on the holding firm’s stability sheet sometimes within the neighborhood of 1.2x that ought to push consolidated return on fairness to a standard vary of 17%-18% in comparison with one thing nearer to fifteen% previous to this yr’s spin-off.

Macroeconomic and Political Image

Colombia’s financial system is definitely performing quite well at the moment, a minimum of from a statistical perspective, though loads of that’s within the context of an financial system persevering with to regain its pre-pandemic kind. Second quarter GDP development was seemingly within the double digits, and expectations for the complete yr is for development of near 7%. The unemployment price has equally declined sharply, all the way down to about 11%, near pre-pandemic ranges. The flip facet of this development has been excessive ranges of inflation and commensurate tightening by the central financial institution.

The macroeconomic image is enjoying out within the context of the election of leftist President Gustavo Petro. Courting again to 2002, Colombia’s three prior Presidents all got here from the political proper. Handicapping the longer term political agenda within the nation can have significance to buyers.

Tax reform will be first on the agenda, with the federal government needing to each cut back the deficit and making an attempt to take action whereas funding social packages on the identical time. One massive objective of the proposed reform is to extend the quantity of particular person revenue taxes collected (notably amongst excessive revenue earners) provided that a big share of presidency income in the present day comes by way of company and worth added taxes. The proposal consists of a rise within the capital beneficial properties price plus the introduction of a wealth tax that turns into efficient for these with a web price of about $700,000 or extra and new taxes on pensions. The oil and gasoline sector can also be focused, with a proposed elimination of a deduction on royalty funds and new taxes on coal. Petro has left little question as to his views on the power business, as he has pledged to cease issuing new permits for exploration and ban fracking.

What really strikes by way of the legislature remains to be not fully clear. The Colombian legislature is comparatively fragmented and though Petro ostensibly has a majority, many members of the coalition are considerably extra average. There are sensible realities in terms of the severity of the governments power insurance policies as nicely, as Colombia depends on the business to fund the federal government and supply an enormous portion of export revenue.

Finally, I consider that the political dangers in the present day are the most important issue why Aval trades at a modest low cost to Bancolombia, regardless of having a mixture of companies that ought to deserve a premium. Whereas Corficolombiana doesn’t instantly personal companies that extract power, they do have vital investments in adjoining industries that could possibly be negatively affected ought to a pointy transfer from fossil fuels happen. Some proposals beneath dialogue at the moment may additionally have an effect on smaller items of Corficolombiana’s enterprise corresponding to a tax on monetary derivatives and elevated resort taxes. And whereas Porvenir ought to emerge from the preliminary tax reform bundle in fine condition, it stays to be seen whether or not the Petro authorities would possibly introduce laws designed to shift extra pension property to the federal government and away from the personal sector.

The Forex Query

For all of the prognosticating on the evolution of the Colombian financial system and the extent to which Petro will depart his mark on the nation’s financial system, crucial query for buyers in Aval might be the route of foreign money markets.

The peso in the present day exchanges at a ratio of about 4,500 to 1, in comparison with a peak of about 1,800 to 1 near a decade in the past and shut to three,800 to 1 previous to Petro’s election victory. Ignoring foreign money when investing in Latin America can be an infinite cognitive error. When foreign money strikes with an investor, it might appear exhausting to make a mistake and if the foreign money doesn’t cooperate, it might really feel not possible to do something proper. Whereas many observers attribute the continuing “pink wave” as a purpose that investing ends in Latin America have been so poor during the last decade plus, foreign money is a extra seemingly root trigger. It’s not solely the direct foreign money translation which causes this, however the larger funding prices and sapped liquidity that may have massive underlying results on the broader financial system.

The greenback is now sitting at 20-year highs towards a basket of world currencies, having begun its present bull market in 2008. Usually the commodity surge seen this yr can be greenback adverse, however steep rate of interest will increase by the Federal Reserve and geopolitical turmoil has despatched the greenback to new highs. Trade charges are notoriously tough to forecast, however given the historic highs that the greenback is reaching and the size of the present bull cycle, the tip of the present tightening cycle may nicely coincide with the tip of the present tightening cycle.

Valuation and Funding Suitability

There has at all times been lots to love in Aval’s execution and dominant positions the place it operates. That is still true in the present day. Traders should be conscious of foreign money fluctuations in addition to political strikes in relation to the power business and pension administration. However, the upside for assuming these dangers is a set of dominant franchises buying and selling for near 4x earnings and fewer than e book worth.

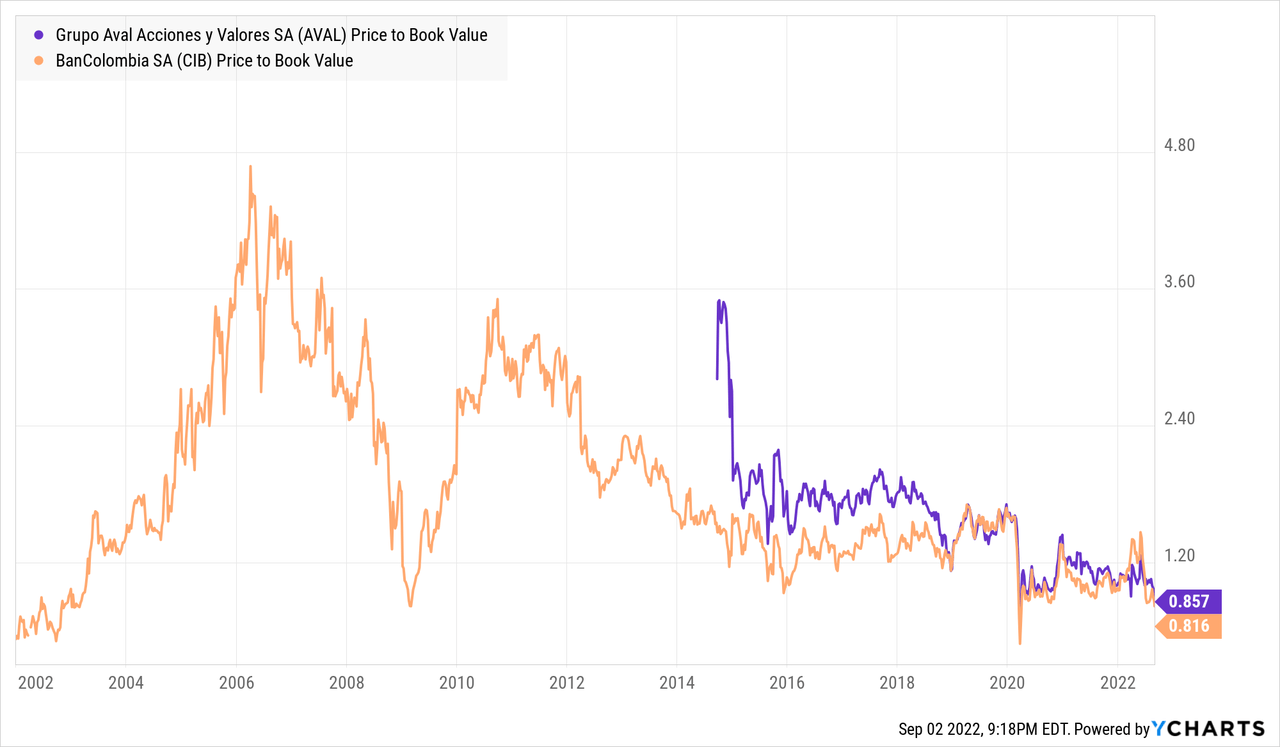

Taking the lengthy view, it has been fairly uncommon for both Aval or Bancolombia to commerce for lower than e book worth (which they proceed to even adjusting for post-quarter foreign money actions). The one time both traded decrease was in 2002, not too far faraway from the 1998 monetary disaster and previous to the approaching nice commodity growth, when Bancolombia briefly traded for about 60% of e book.

Equally, viewing pre-pandemic multiples of earnings present an inclination of a a number of of between 5x an 15x, with a few outliers under 5x. Once more, the low right here was Bancolombia in 2002 when it touched 3x earnings.

That doesn’t imply that in the present day’s valuations current no draw back in any respect, but it surely does imply Aval has hardly ever been cheaper and valuation dangers skew strongly to the upside over the long run. Concentrate on the dangers, however greenback price averaging into Aval (and even Bancolombia for these buyers wishing modestly much less threat) over the following yr whereas in search of a looking greenback peak appears to be an eminently cheap technique.

Source link