Journey + Leisure Inventory: Lastly Indicators Of Progress (NYSE:TNL)

Giselleflissak/E+ by way of Getty Pictures

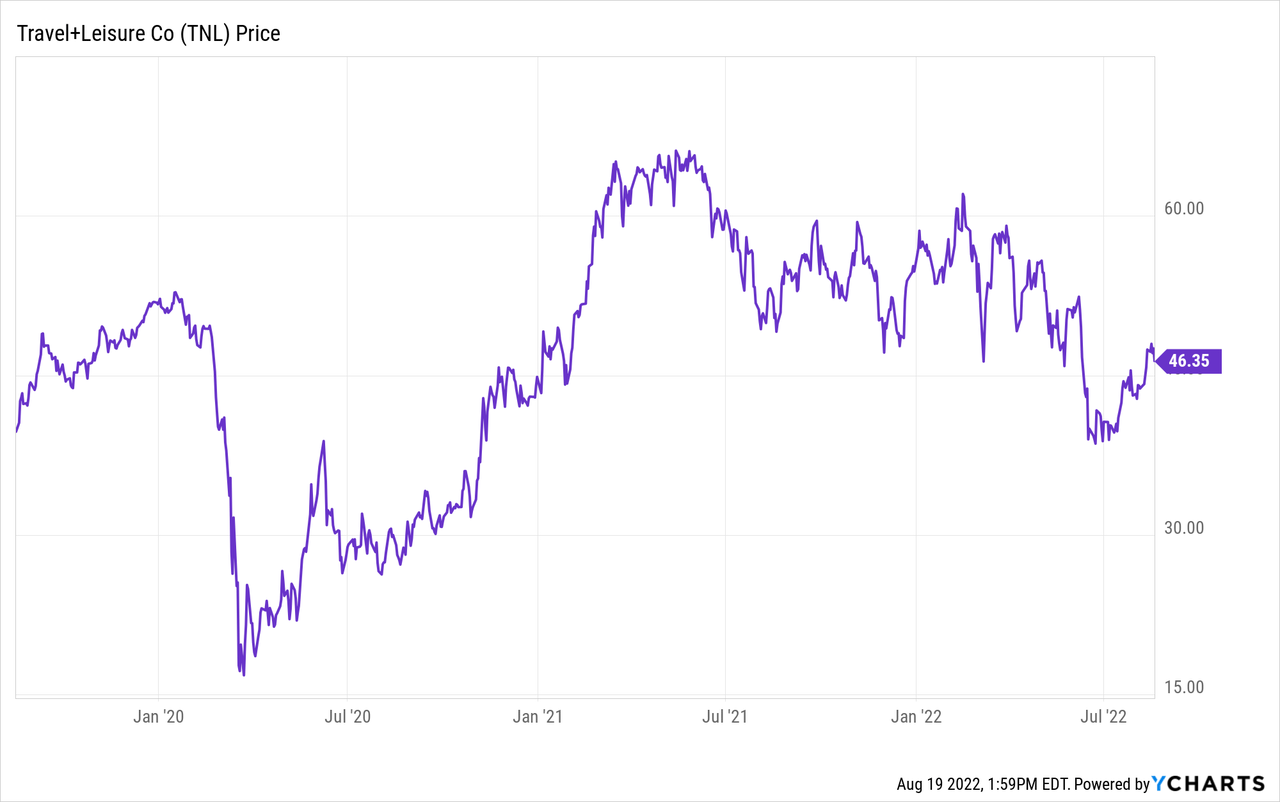

Journey + Leisure (NYSE:TNL) has been quietly rebuilding its trip possession enterprise following the COVID pandemic. The corporate spun out of the worldwide hotelier large Wyndham, leaving many to query the corporate’s future, some even going so far as to recommend that the spin-out would sign the top of the timeshare business as we knew it. Issues have turned out fairly in a different way for the corporate. Below the management of business veteran Michael Brown, the corporate has managed to face up to main structural adjustments and a worldwide well being disaster that disproportionately affected the hospitality business. As if that weren’t sufficient, the corporate is now dealing with the prospect of a serious world slowdown as central banks attempt to handle rampant inflation. Regardless of this, the corporate appears to be firing on all cylinders and is entering into a vital subsequent few quarters that may present traders with perception into the corporate’s resilience as we glance to start out the subsequent enterprise cycle.

In the present day we are going to check out Journey + Leisure and talk about what traders can count on from the corporate going ahead (I’ve lined the corporate up to now, for a extra detailed firm profile, try this article).

Firm Outlook

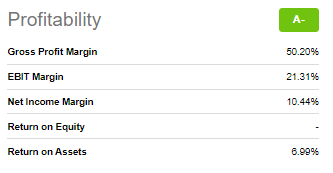

Following the spinout, I have to confess that I had my justifiable share of reservations as as to if the corporate may preserve its robust gross sales quantity with out making concessions within the per-unit worth, which might, in fact, impression gross margins. Up to now, this concern has confirmed to be unfounded, as the corporate is posting gross revenue margins north of 60%.

Searching for Alpha

That is an incredible quantity. Keep in mind, this isn’t a software-as-a-service kind enterprise. As a substitute, the corporate is promoting trip possession pursuits in its current portfolio to clients it probably needed to pay advertising prices to accumulate. These advertising prices manifest primarily within the type of the presents the corporate affords to entice individuals into attending gross sales displays. Timeshares are notoriously robust gross sales, and it usually takes a number of visits to lastly persuade a buyer to buy. This is the reason traders are likely to pay eager consideration to gross margin and advertising prices figures, because it offers main perception into the general enchantment of the product. Proper now, Journey + Leisure is clearly knocking it out of the park.

Within the latest earnings name, the corporate reported a powerful Adjusted EBITDA of $230 million, which was good for an EPS of $1.27 cents. In addition they managed to provide a file quantity per visitor of $3489. Quantity per visitor is in impact the sum of money the corporate makes per tour it undertakes. The fascinating factor about that is that for the second quarter, greater than 65% of recent proprietor gross sales had been to Gen-Xers and millennials. The significance of this can’t be overstated when you think about the background of the timeshare business. Airbnb (ABNB) and different different trip choices had been being touted as timeshare killers. The final expectation was that as these providers turned extra widespread, the timeshare business would ultimately die out. The corporate managing to create worthwhile relationships with youthful homeowners is so essential. It’s also price mentioning that new proprietor gross sales usually carry a decrease VPG than current proprietor gross sales, and that new homeowners have a tendency to return again and buy extra possession down the road. The corporate additionally talked about that just about 80% of its proprietor base is touring debt free. This implies their trip possession is totally paid for, and their solely commitments are the annual upkeep charges. It will be truthful to say that the corporate it is at the moment in place with its proprietor combine and is displaying indicators that it’s creating additional in the proper route. However with the financial slowdown on the horizon, there are some issues in regards to the enterprise mannequin’s vulnerability to defaults.

Debt Issues

Timeshares are, initially, a luxurious buy. Holidays are sometimes seen as optionally available endeavors, though they in all probability ought to take larger precedence. Timeshare corporations assist their clients go on trip by having them decide to the acquisition of an possession curiosity in a property or portfolio, permitting them to lock within the worth of their holidays for essentially the most half, aside from occasional changes to annual upkeep charges. As a result of timeshares are typically dear big-ticket purchases, clients are likely to finance the acquisition no less than partly with debt. This observe is generally superb, and the corporate does a fantastic job at screening its purchasers to make it possible for they will deal with the monetary commitments that come together with the acquisition. But when there have been to be a widespread financial slowdown because of the Federal Reserve tightening to handle inflation, for instance, the fallout wouldn’t solely dent client confidence which might be a headwind for brand new purchases, however it may additionally lead to higher than regular delinquencies in financed trip possession merchandise which might grow to be fairly problematic for these kind of corporations. The nice factor is that these corporations have gotten higher at working with clients via tough instances to maintain their homeowners pleased and to forestall widespread harm to the corporate.

Valuation And Ahead-Trying Commentary

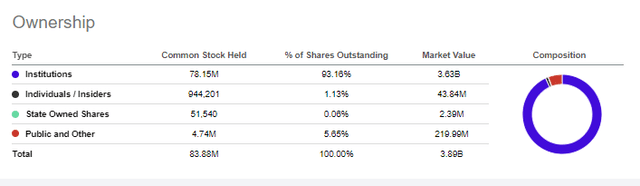

Regardless of these issues, Journey + Leisure nonetheless attracts a number of the premier traders on the earth. Establishments personal a whopping 93% of shares excellent, which is all the time a fantastic signal at any time when there are issues a few recession.

Searching for Alpha

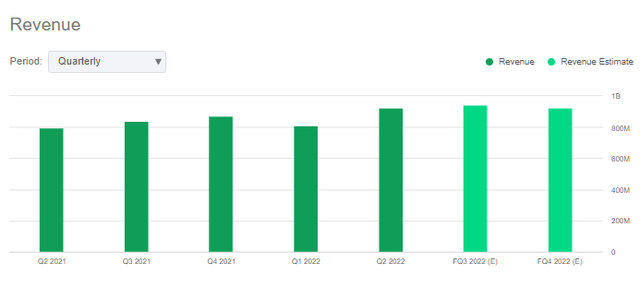

The corporate can also be in the course of a stable restoration from the COVID-19 pandemic, and regardless of the seasonal nature of income within the hospitality business, income developments have been kind of steady, which is an effective signal.

Searching for Alpha

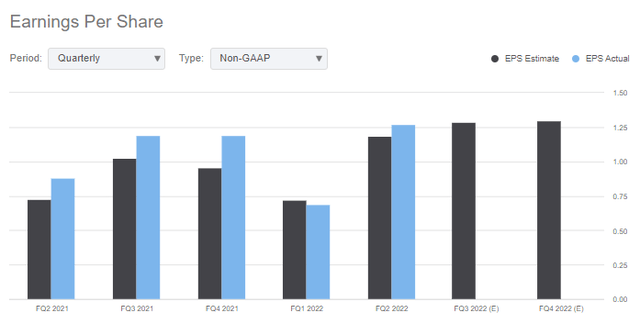

The administration staff has had a stable monitor file of delivering to earnings expectations, and we are able to see that for the final 5 quarters, they’ve carried out exceptionally properly with 4 beats and one small miss. It’s also price mentioning that the winter interval tends to be one of many stronger quarters for timeshare corporations.

Searching for Alpha

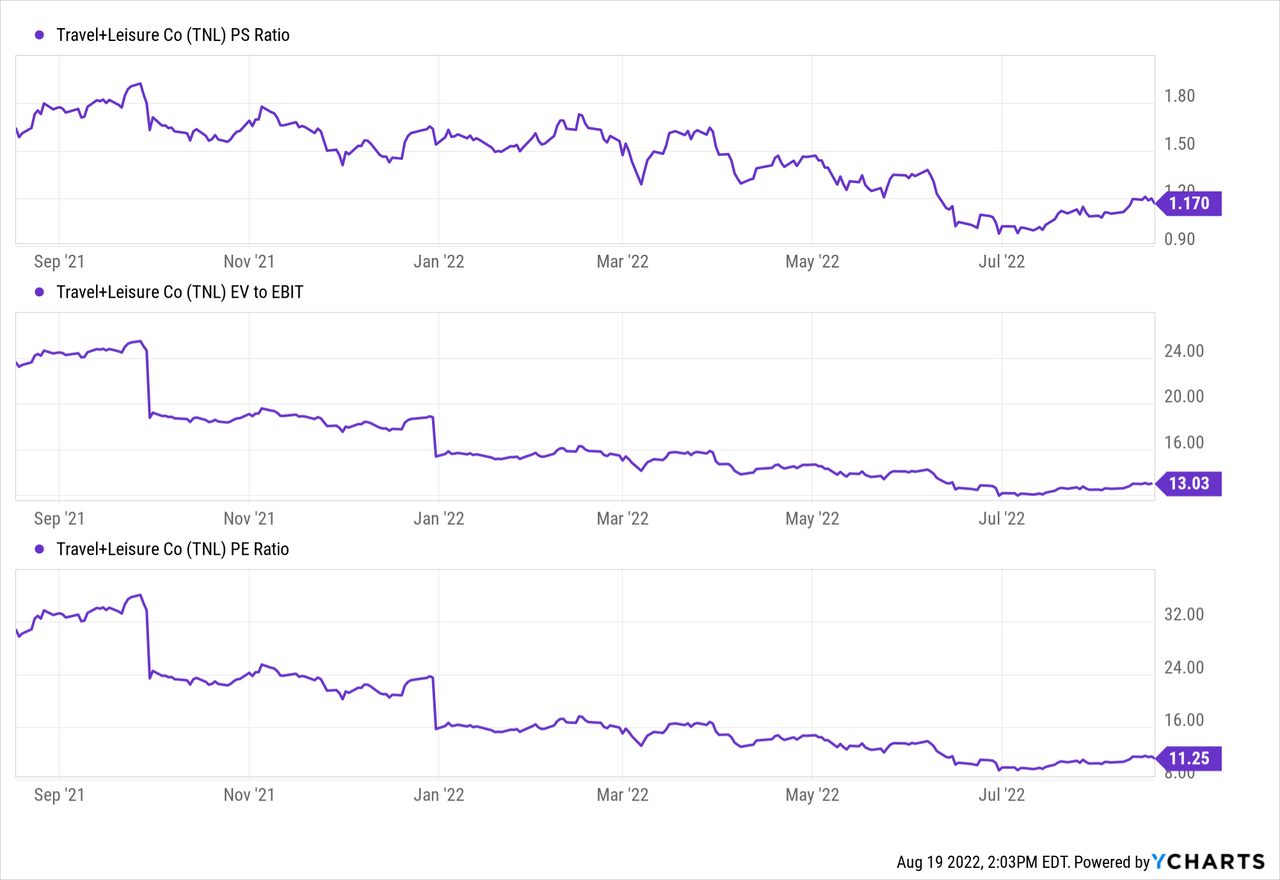

The corporate can also be buying and selling on the low finish of its historic ranges for many of the vital multiples, which often implies worth.

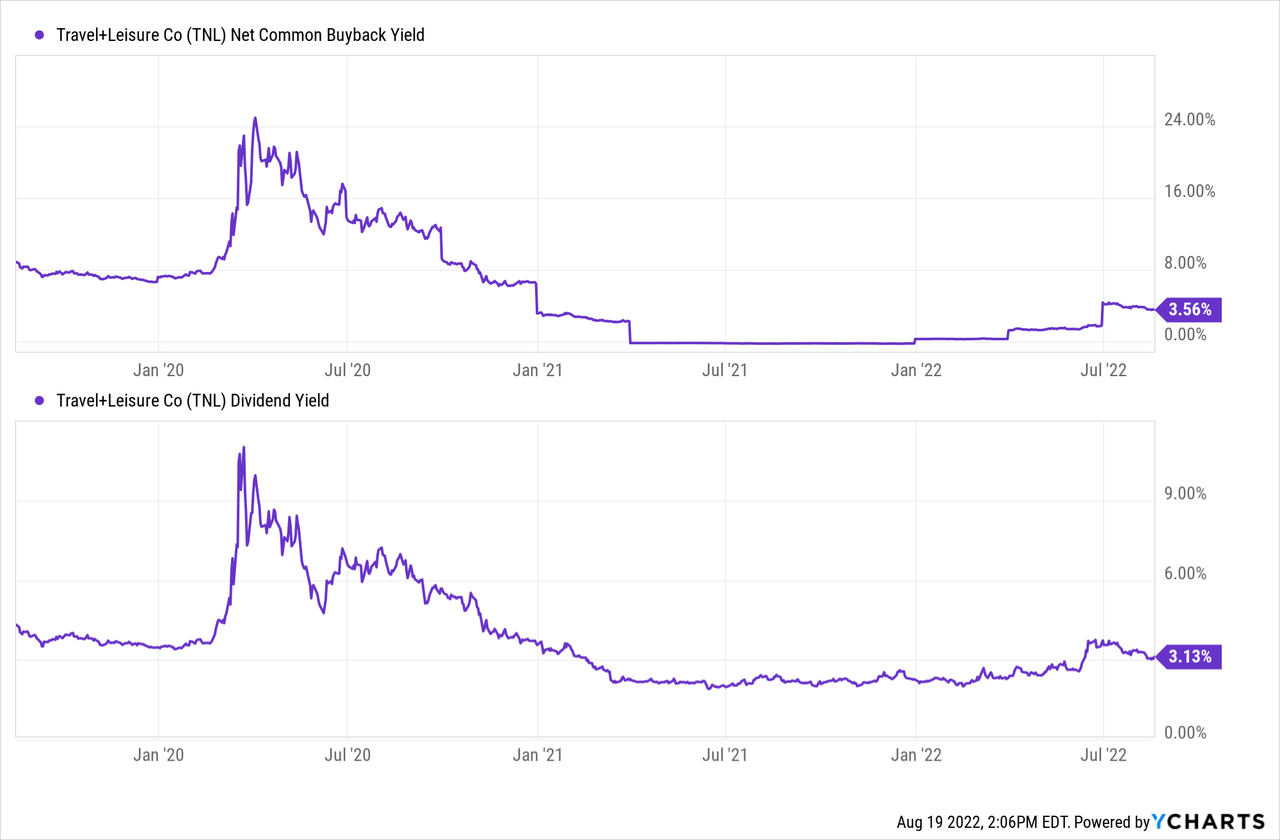

There’s additionally the stable dividend and good monitor file of repurchases on this house that may present some incentive for traders whereas they look forward to the commerce to pan out.

The Takeaway

In closing, the principle spotlight right here is the advance within the penetration of the youthful section of the financial system. The danger of defaults is, in fact, heightened in the intervening time, however a reasonably excessive proportion of the corporate’s homeowners have paid off their loans. In the long run, I do consider that Journey + Leisure might be larger than present ranges, however within the quick time period, there are some severe dangers for the investor to think about earlier than taking a place. Because of this, I charge Journey + Leisure a long-term purchase.

Source link