SeaWorld Leisure (NYSE:SEAS) shareholders have earned a 32% CAGR during the last 5 years

For a lot of, the primary level of investing within the inventory market is to attain spectacular returns. And we have seen some really superb good points through the years. For instance, the SeaWorld Leisure, Inc. (NYSE:SEAS) share value is up a whopping 303% within the final half decade, a good-looking return for long run holders. And this is only one instance of the epic good points achieved by some long run buyers. And within the final month, the share value has gained 34%. However this might be associated to good market situations — shares in its market are up 14% within the final month.

Let’s check out the underlying fundamentals over the long run, and see if they have been in line with shareholders returns.

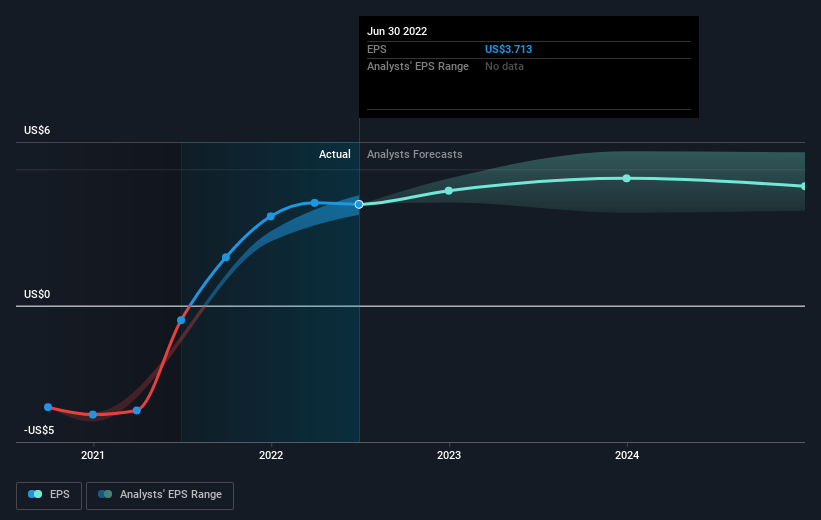

Whereas markets are a robust pricing mechanism, share costs mirror investor sentiment, not simply underlying enterprise efficiency. One flawed however affordable technique to assess how sentiment round an organization has modified is to match the earnings per share (EPS) with the share value.

Through the 5 years of share value progress, SeaWorld Leisure moved from a loss to profitability. That type of transition may be an inflection level that justifies a powerful share value achieve, simply as we’ve got seen right here. For the reason that firm was unprofitable 5 years in the past, however not three years in the past, it is price having a look on the returns within the final three years, too. Certainly, the SeaWorld Leisure share value has gained 71% in three years. Throughout the identical interval, EPS grew by 52% annually. This EPS progress is increased than the 20% common annual improve within the share value over the identical three years. So that you may conclude the market is a bit more cautious concerning the inventory, as of late.

The graphic under depicts how EPS has modified over time (unveil the precise values by clicking on the picture).

We like that insiders have been shopping for shares within the final twelve months. Even so, future earnings might be much more essential as to if present shareholders generate profits. It could be nicely worthwhile having a look at our free report on SeaWorld Entertainment’s earnings, revenue and cash flow.

A Totally different Perspective

It is good to see that SeaWorld Leisure shareholders have obtained a complete shareholder return of two.4% during the last 12 months. Nevertheless, that falls in need of the 32% TSR every year it has made for shareholders, annually, over 5 years. Potential consumers may understandably really feel they’ve missed the chance, nevertheless it’s at all times potential enterprise continues to be firing on all cylinders. I discover it very attention-grabbing to have a look at share value over the long run as a proxy for enterprise efficiency. However to actually achieve perception, we have to think about different data, too. To that finish, you ought to be conscious of the 4 warning signs we’ve spotted with SeaWorld Entertainment .

In case you like to purchase shares alongside administration, you then may simply love this free list of companies. (Hint: insiders have been buying them).

Please be aware, the market returns quoted on this article mirror the market weighted common returns of shares that at present commerce on US exchanges.

Have suggestions on this text? Involved concerning the content material? Get in touch with us straight. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We goal to deliver you long-term targeted evaluation pushed by elementary knowledge. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.

Source link